In July, the UK inflation rates hit an all-time high of 10.1%, with the Bank of England projecting an increase to 13% by the end of the year. Citigroup expects an even higher spike next year, reaching 18%, the highest among other large western economies.

It seems we are headed for recession. The largest economies in the Euro area are fighting against the shrinking output while costs skyrocket with no indication of slowing down.

SMEs caught within this landscape are up against increased costs which could result in catastrophic effects on the “backbone of the economy.” Representing 99% of all businesses in the EU and the UK, their failure could cause mass unemployment, dips in innovation, and competitiveness on the global stage.

“The current economic outlook for small businesses is precarious,” said Steven Scoufarides, Head of Broker Channel at iwoca. “We are seeing signs of an increasing number of SMEs searching for financial solutions to manage their cash flow and brace for the potential of a recession.”

Government support through the strain

For many, the question turns to the governments and how they plan to support SMEs through the gathering headwinds of the crashing economy. There is a spike in SME lending, showing resilience from SMEs; however, some experts see this only as a short-term solution.

“Inflation continues to escalate, and with it, so does the challenge to SMEs,” said Chirag Shah, CEO and Founder of Nucleus Commercial Finance. “The impact on households quite rightly dominates the narrative, but the plight of businesses demands attention too. Not only are they seeing their overheads squeezed further, but they are also faced with the prospect of contracting demand. It’s a perfect storm.”

“Businesses may be able to get by for a while by battening down the hatches, but that’s nothing more than a short-term strategy, and all indicators suggest that this is not blowing over any time soon.”

“Markets are worried, consumers are anxious, and there’s leadership uncertainty in Number 10. Johnson’s successor must deliver clear, decisive, and impactful policies from the outset of their tenure. Working closely with the business community, it is essential that they not just take the necessary steps to rein in inflation, but also give much-needed financial support to UK SMEs that enables them to continue to drive the UK forward.”

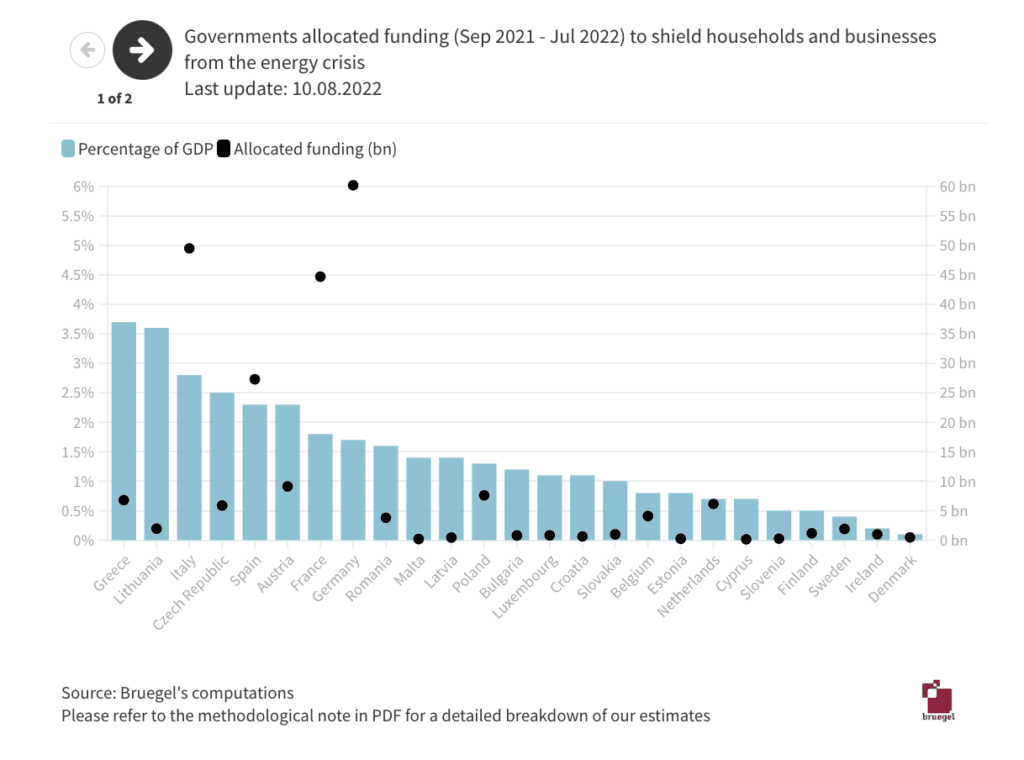

As stated by Shah, many government efforts to date are focused on relieving the inflationary burden on households. Energy prices have increased significantly, and the UK and EU governments have allocated funding to shield the most vulnerable from the rising cost of living. Member states of the EU have also implemented additional compensation measures for businesses. In July of this year, the EU agreed to reduce reliance on natural gas by 15% this winter.

Although supporting SMEs through the pandemic with various government-backed loans, the UK is undecided on further support to target the rising inflation. Business leaders are calling for more focused plans to counteract the added strain.

Despite this, many experts do not believe that increased lending is the way forward. “I’m far from convinced that facilitating SMEs taking on even more unaffordable debt is the right solution,” said John Davies, executive chairman of Just Cashflow and chairman of the Association of Alternative Business Finance.

“I appreciate we are living in strange times, but normally debt shouldn’t be used to fund long-term losses—it is there to fund working capital for growth. It is equity/capital that should cover losses.”

‘Lean and mean’ or embracing growth

Consumers have seen the change in prices as businesses attempt to counteract the rising costs, many resorting to implementing their own survival plans.

“We know small business owners have been left with little choice but to implement survival tactics,” said Alan Thomas, UK CEO at Simply Business. “Half (49%) will raise prices, 48% are halting new hires, and 40% are putting expansion plans on hold.”

However, some SMEs also seem to prioritize growth. Although SME loan requests have increased, along with the value requested, reports show that the reasoning behind funding has changed. A recent survey by iwoca showed that many SMEs still had plans to grow, many citing it as the main reason for seeking funding.

According to Joe Cambereto, CEO and Founder of National Business Capital, there are two options for weathering the storm.

A recent Forbes article wrote, “Businesses have two options in today’s business environment—stay lean and mean or commit to growth. At this point, it’s hard to manage anything in between these two choices.”

He suggested cutting back non-essential costs and improving marketing to current customers for those who choose to stay small. For those who choose growth and increased investment, he explained they could, in this way, stay ahead of inflation and the competition. Increased expenditure on new technology and improved processes to reduce overhead costs was suggested, while others have recommended increased marketing.

For both strategies, the lending sector could be critical in keeping the SME economy alive.

A new way through embedded finance and open banking?

For many, embedded finance and open banking could pave the way for increased SME support. Alternative lending has seen growth in 2022, and embedded finance could streamline the process of targeted lending where SMEs need it most.

“We believe that embedded finance is the future of SME lending across Europe,” said Colin Goldstein, commercial growth director at Iwoca.

“Data and technology now make it possible to deliver finance to SMEs quickly and seamlessly within the services and platforms they use to run their businesses daily, whether that’s their bookkeeping software, eCommerce platform, or digital bank account.”

“SMEs will increasingly, over time, expect and demand this ease and speed of access. Embedded finance is set to entirely transform how SME loans are distributed.”

Accenture showed in a recent analysis that embedded banking could capture up to 26% of SME revenue by 2025. This, along with the integration of open banking, could make loan applications quicker and easier for SMEs, allowing quick loans to cover cash flow.

Embedded finance for increased revenue and affordability

Embedded finance, as well as providing alternative lending options, could also provide alternative revenue streams.

They could attract more customers despite rising costs by facilitating easier payments and creating more affordable options using embedded solutions like BNPL.

In July, it was found that four out of five adults within the 18-34 age in the UK used embedded finance, and the sector is set to continue growing by 20% each year between 2022-2029.

Options for plug-ins and platform integrations could improve customer loyalty and retention with loyalty programs and back-end software to track costs. According to a study by Plaid, 88% percent of companies implementing embedded finance report increased engagement, and 85% say that it helps them acquire new customers. Both factors are increasingly important for the problematic landscape ahead.