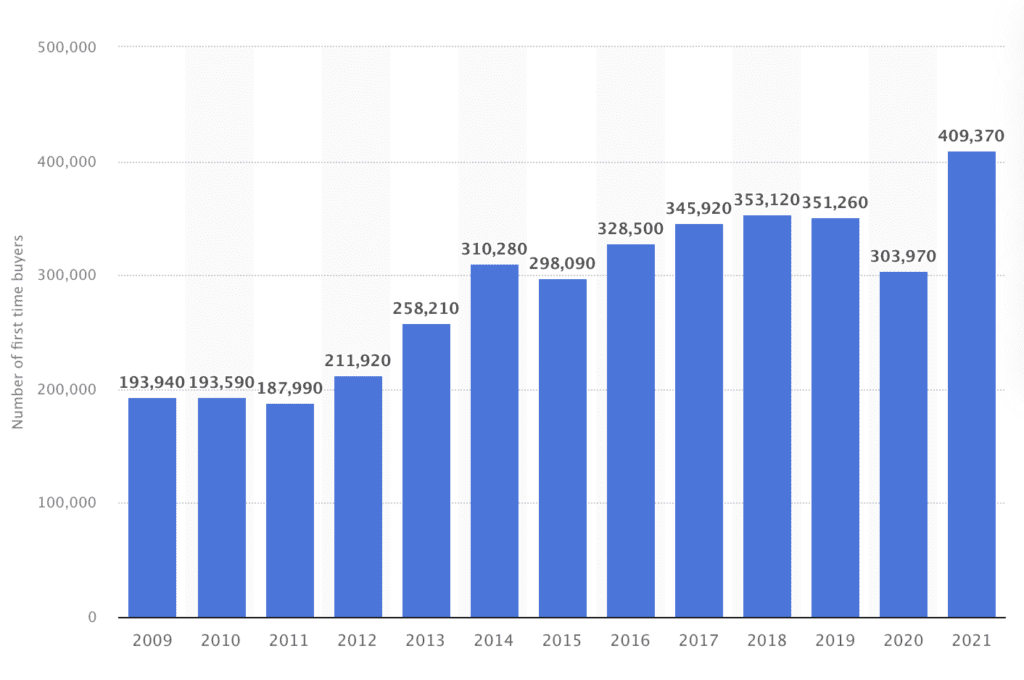

The market rollercoaster for first-time homeowners in the UK may have ended but continues to be challenging. Following the dip in 2020, experts say was caused by the stamp duty holiday, rates of first-time buyers increased again in 2021. However, house prices continue to rise, and younger generations must wait to buy a house.

The average age of first-time buyers has crept up to 34 years of age, 6 years older than 15 years ago. Around 55% of 25-34-year-olds rent homes rather than buy.

“Based on our analysis, there are about 2.4 million people who rent but could own in the UK,” said Trevor Stunden, CEO and Co-founder of Kettel Homes. “That doesn’t seem to be getting smaller. When you think about the last six months and the challenges we see, overall demand is generally softening because of interest rates and other challenges. However, there is still very much demand available.”

“What we found was the three major challenges that first-time buyers are having, which may come as no surprise is; the affordability, their credit, and their deposit.”

“We found was that there’s a large gap for people who had some savings for a small deposit, they had the means to get themselves to a larger one, but they also didn’t understand the process. What ends up happening is they flounder in the private rental sector, not doing what they should be doing to get themselves to homeownership.”

Help to buy equity loan became too big for the government

The government has led various programs to encourage first-time buyers and make real estate more affordable despite rising prices.

The Help to Buy: equity loan program was started in 2013 and was projected to run for ten years, coming to an end in March 2023. It offers first-time buyers who can afford fees and interest payments a chance to buy their first home in new builds with a loan of 5%-40% of the property purchase price. Applicants must pay a deposit of at least 5% and arrange a repayment deposit of at least 25%.

Since its inception, the scheme has facilitated 350,000 first-time buys. According to Stunden’s contact in Homes England, Nick Merkley, it has become too large a sum on the public balance sheet, amounting to around £23 billion in debt.

“It’s a good program; it’s just become too big for the government,” said Stunden. “The limitation of that program is that it’s only on new builds. Kettel primarily focuses on existing builds. One benefit we provide is that we’re getting people into homes that aren’t costing the planet in terms of emissions.”

“Existing builds also have a much more stable growth rate. If you’re moving into a new build, generally, you’ll be in negative equity for the first three to four years because of the premium associated with buying a new build.”

“Additionally, there is a limitation on the number of new builds available. Suppose you think about the types of properties that we buy. Based on land registry data, anywhere between 350,000 – 400,000 units trade within our core criteria annually.”

In addition, users of the Help to Buy scheme must pay the government a share of the increased price of the property when they pay off the mortgage or decide to sell their home.

Shared ownership scheme flawed

The other government program aimed at boosting first home ownership is the Shared Ownership Scheme. Applicants can buy a share of a home with a housing association, local council, or other organization. They must pay a deposit from 5%-10% of the property price and purchase between 25% and 75% of the remaining house price through savings or a mortgage.

Applicants then pay rent on the remaining share of the property to the organization offering the scheme, with the option to “staircase” by buying more shares over time.

“Our personal view on this is that it’s a bit of a flawed program,” said Stunden. “The only place where I see it to be useful for customers is in a costly environment like Central London, where somebody wants the security of tenure, and they have no real desire to own the home. The level of true homeownership that anybody moves from in the shared ownership product is extremely low; I think it’s around 2% a year. It’s very, very bad.”

“There are also disincentives. Let’s say you own a portion of the home; let’s say it’s 25%. If you staircase up, reselling your home at a higher staircase, let’s say you got to 50%, you actually become unattractive for a resale market because the people who are looking to get onto the shared ownership aren’t looking to buy 50%, they’re looking to buy the minimum value.”

The shared ownership terms also change according to the market values. “It’s been challenging for people in the past few years to either save the amount needed or understand the growth rate because they only own a portion,” he continued.

Kettel has structured itself to resolve these issues

“The big difference between us and any of these other programs is that we’re fixing the property price, rent, and savings during that period. So it gives you a clearer understanding of what you need to do to achieve your goal of homeownership,” said Stunden.

Applicants to Kettel’s rent-to-own program choose their home and could be granted assistance as long as it resides within Kettel’s metrics. “Our acquisitions team uses about 150 data points to go through and make sure that the property fits our criteria. We only approve single-family homes, not flats, because we want our customers to move into a home they can own for many years.”

“Historically, from a data perspective, if you live in a two-bed or one-bed flat, you live in it until you grow out of it. Whereas these are freehold houses, they’re much cleaner ownership structures and much better from an ownership perspective.”

The application process is similar to a mortgage, with less focus on credit scores. “We have a little more flexibility because we’re not a credit product. We’re a standard landlord-tenant relationship.”

Household income is assessed, and a deposit of at least 2% is required. Kettel then calls the applicant and provides a budget.

On approval, the fixed rental agreement is set for the first 36 months, with a certain percentage going into a linked lifetime ISA. The amount that goes towards savings is calculated with the aim for the homeowner to reach 10% of the property price, which is fixed from the moment of entry into the agreement. The company reports all rental payments to credit rating agencies, building the applicant’s credit rating.

“One of the key pieces for our customers is that they have a clear roadmap of how much they’re spending every month and what the repurchase price will be no matter what,” he continued. “The added benefit is they have a professional buyer to go through all the details of the purchase with a level of scrutiny that most first-time buyers wouldn’t be able to do.”

Nationwide shows interest

Kettel’s scheme has attracted industry attention, with Nationwide being one of the first to invest.

“The business has a social impact component,” Stunden explained. “Getting people on the housing ladder is one of the best ways to provide somebody the stability for their family, and for them to invest both in themselves and their communities. It’s also the greatest way of creating wealth. In the UK, most wealth is stored in real estate.”

“Those things all coupled together in Nationwide. I believe they’re the largest lender to first-time buyers, so it’s a very clear opportunity for them to support the ecosystem they’re part of.”

What can be done to improve the market?

Kettel’s product could ease the way for first-time owners. However, the market itself could also be adjusted to create a lower barrier to entry for the demographic.

Stunden believes three main things could change to help the first-time buyer:

- “As the average home price increases, the government needs to increase the threshold of stamp duty relief. The entire market is moving, and I think stamp duty needs to move with it regarding the thresholds.”

- “I would like to see the government increase the lifetime ISA bonus program, even if it’s structured in a way where you can start saving before you’re getting taxed. I think it would be useful.”

- “Education, and educating first-time buyers. Unfortunately, it’s not something they teach you in school. It’s the biggest purchase of your life and one of the most stressful things you’ll ever do (based on several surveys). So having a level of education and a transparent structure would be very useful.”