While most banks have some type of financial education strategy, few customers realize it. That makes those efforts futile, results of a study by Greenlight reveal.

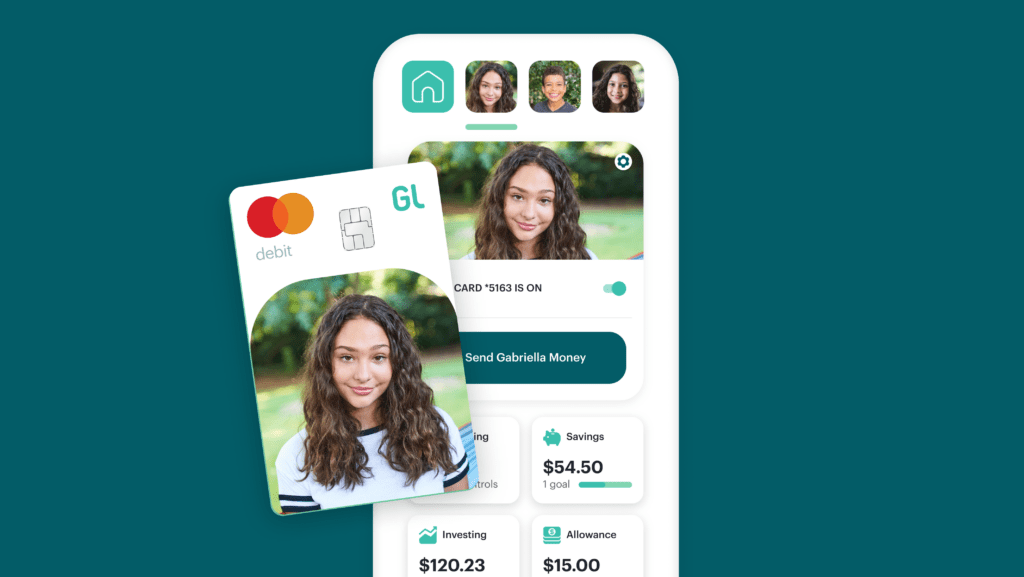

VP of business development Matt Wolf described Greenlight as a family finance company. It offers a banking app and debit card. Both help teach kids and, in many cases, their parent’s smart financial habits. Roughly six million people are registered with Greenlight. Together they have saved over $300 million and invested $20 million.

JP Morgan Chase’s Chase First Banking uses Greenlight technology, Wolf said. More than one million families use the service.

How Greenlight pivoted to meet the financial literacy need

With few American school systems teaching financial literacy, parents rate it as their number one concern, Wolf said. It was for Greenlight’s founders, who together have seven children. They started the company because they wanted a reliable solution they could use to give money to their children while having the ability to set spending limits.

Early customers told Greenlight they also used the app to teach kids intelligent financial behavior, so the company invested in financial literacy. They hired education specialists to create mobile-friendly videos and quizzes that are gamified to allow customers to earn virtual (and soon, physical) goods.

“We found through our research that it makes the kids want to keep coming back and take more lessons,” Wolf said. “It’s called Level Up because we want them to get to higher levels in their financial knowledge.

“Some parents come to us and say they learned a lot by playing this game with their child. We expect this could be something kids and parents could do together.”

Most banks have financial literacy strategies, but you wouldn’t know it

People are embracing the app because there is a perceived lack of financial literacy options on the market. Most people surveyed, 93%, believe banks should be helping families with financial education, but only 15% say banks are doing it. With most banks having some sort of financial literacy strategy, that’s a clear message to those many efforts that fail to reach their target audience.

Also, read:

Why are so many efforts so ineffective? There are several reasons, Wolf said. One of the biggest is that they don’t meet younger generations where they are – in the mobile realm. Within the next few years, 42.9 million members of Generation Z will be mobile banking. A digital-first program is crucial.

Most banks do not have the time, money, or qualified staff to develop an effective program in-house. That’s where Greenlight comes in, Wolf said. Greenlight for Banks enables banks to offer Greenlight’s family banking and educational products for free to their customers. Parents can automate allowance, reward kids for completing chores, and instantly send money to their kids. They can also limit kids’ spending in specific categories and locations. (The app can be downloaded directly from Greenlight’s website for a small fee.)

“As long as it was on the Google Maps API, you can limit it to that granularity,” Wolf said while adding location sharing, SOS alerts, and crash detection with automatic 911 dispatch are also available.

Banks quickly realize partnership benefits

Clients can co-brand the process through a co-branded landing page, registration, and app experience. They can be up and running in three weeks, Wolf said. Kids can even design their physical debit cards. In the works are new games and rewards, including the ability to provide physical rewards like account deposits for completing tasks. Coming this summer is an SDK that provides the whole Greenlight experience within an institution’s app.

With many banks losing deposits, Greenlight allows them to attract some. Banks can hold deposits in their institution instead of with Greenlight’s partner banks.

“The only consistent thing is that the funding source for Greenlight needs to be the partner bank,” Wolf explained. “When a parent registers for Greenlight, they need to use that partner bank or credit union’s DDA account or debit card to fund the Greenlight parent wallet for it to be free.” (People can also get Greenlight’s apps directly from the company.)