San Franciso-based Treasure Financial announced a partnership with Grasshopper Bank, launching a new platform for businesses to invest their treasury cash balances for high returns.

A release said that through the partnership, Grasshopper gained greater access to SMB relationships, and Treasure received FDIC secured deposits and better payment opportunities.

The Grasshopper BaaS platform runs on the API of partner Treasury Prime.

TaaS market competition

Treasure CEO Sam Strasser said Treasure strengthened its position in the Treasury management as a Service (TaaS) market.

“Working with Grasshopper is the next step in the growth of Treasure, helping us to provide even more automation and improved yield production to our customers,” Strasser said. “Grasshopper’s digital solutions are built on a similar idea as our own: driving and transforming businesses’ finances.”

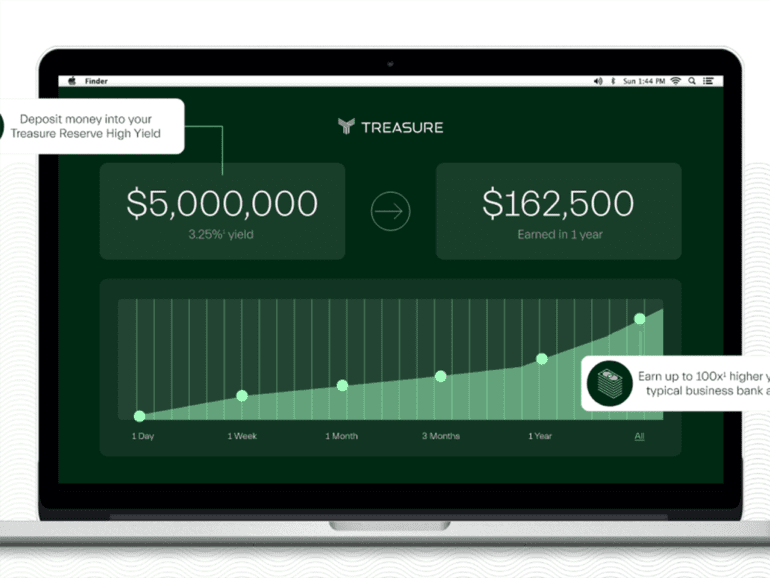

Treasures TaaS enables fintechs, startups, and businesses to invest their cash in high-yield funds, with the liquidity of a one or two-day withdrawal period, Strasser said.

“We are excited to have the opportunity to bring our offerings together and further strengthen the value-add to our customers.”

The firm said in a release that Treasure and Grasshopper are working together to help all businesses access the same financial services as large corporations. Accordingly, Treasure’s platform is positioned as the solution to optimize business finances in real-time without friction.

‘Another great win’

Businesses already in the Grasshopper ecosystem can open accounts on Treasure’s platform instantly to safely generate an optimized yield that rises as the Fed rates, all with no limits on deposits or earnings. Grasshopper CEO Mike Butler said Treasure is the leader in the TaaS space.

“Treasure is the leader in Treasury Management as a Service that keeps building, offering, and strengthening their product, and we’re excited to partner with them,” Butler said. “We believe in their business model and look forward to helping them achieve their growth goals.”

Butler said that the two firms also have a strong alignment in their markets and that offering this type of platform to their clients in the future “will be another great win.”

In the year’s second half, Treasure said they plan to announce more product offerings as they continue to grow, build, and expand their platform to satisfy their rapidly growing customer base.

Treasure Financial offers money management designed for the specific needs of venture-backed and growing businesses, a release said. They claim products like the “ultra-safe Treasure Cash™ earn 30x* more than regular treasury management, and “Treasure High Yield earns up to 100x” more.

Related:

Either way, they boast a short time frame, 10 minutes, to transform cash flow into revenue, to help turn finance departments “from cost centers to profit generators.”

Grasshopper has $500 million AUM, a self-described client-first digital bank serving the business and innovation economy.

Grasshopper said its banking solutions cover small businesses, venture-backed companies, fintech-focused Banking-as-a-Service (BaaS) and commercial API banking platforms, SBA lending, commercial real estate lending, and yacht financing.