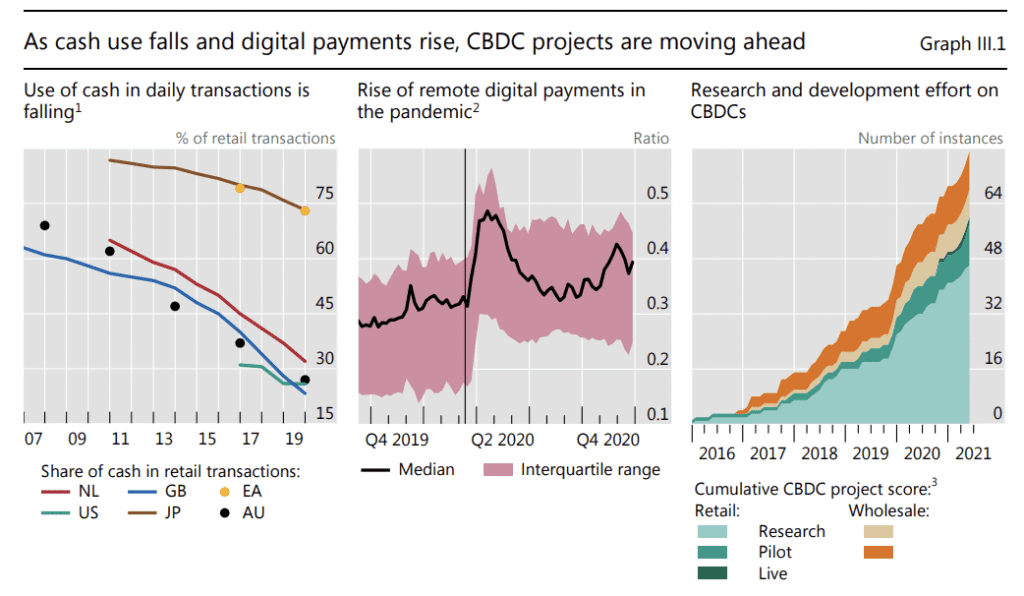

The road to launching CBDCs is long, and many are skeptical it will be successful in retail use cases. However, the wholesale use case is looking promising.

Even the UK House of Lords’ scathing report — “CBDCs: A solution in search of a problem?” — couldn’t deny that.

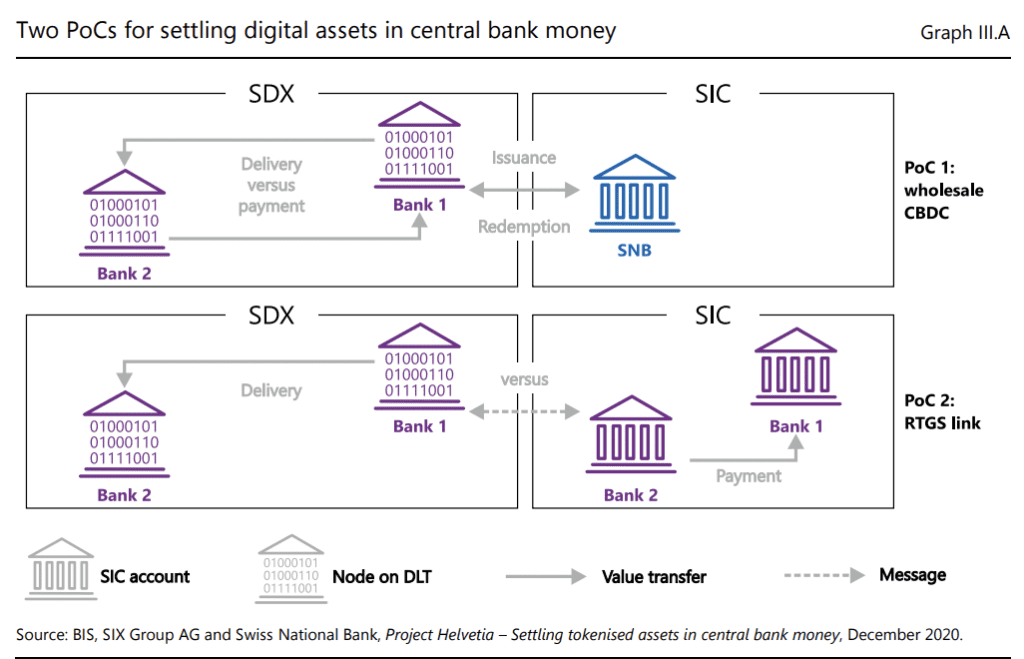

Research from the Bank of International Settlements found that “CBDCs offer in digital form the unique advantages of central bank money: settlement finality, liquidity, and integrity. They are an advanced representation of money for the digital economy.”

While we wait for fully fledged CBDCs, Real-Time Payments are gaining popularity. In 2021 the global market for real-time payments was valued at $13.55 and was expected to grow at a compound annual growth rate of 34.9% from 2022 to 2030.

Aimed at improving security and reducing wait times for cross-border payments (much like wholesale CBDCs), many banks worldwide are integrating the systems.

This week Fidelity Information Services (FIS) launched its real-time payments infrastructure. RealNet Central helps central banks transform their markets into digital-first, real-time payment economies.

“We’ve seen an interest in payments and how to upgrade national mission-critical infrastructure and to keep up with trends like real-time payments, digital assets, and central bank digital currencies,” said Julia Demidova, head of strategy for real-time payments and central bank digital currencies at FIS.

“We can cover the whole payments value chain and help nations transform to a digital-first real-time economy.”

Digital-first mindset

According to the Worldpay from FIS 2022 Global Payments Report, 72% of the world has or will have access to instant payments. Currently, 60 nations have a live, real-time payment infrastructure.

The RealNet Central infrastructure released by FIS aims to accelerate this progress further, providing a virtual lab to allow commercial and central banks to experiment with digital currencies.

The infrastructure connects countries’ businesses, consumers, and financial institutions to real-time networks domestically and internationally.

Aman Cheema, head of global real-time payments and CBDCs, FIS, says: “While the idea of making payments in real-time may sound simple, the reality of delivering on that promise is enormously sophisticated, especially when doing so across borders.

“Our latest offering changes, bringing consumers, businesses, financial institutions, and governments closer together in the payments ecosystem.”

CBDC lab could push forward development

Worldwide, nations are creating and testing CBDCs and their interaction with other central banks. Currently, there are nine cross-border wholesale test projects and three retail. Despite that, 105 countries worldwide are exploring the idea.

The path to launching a CBDC is a long one, especially in large markets. China, one of the forerunners in producing its own CBDC, has been exploring the idea since 2014 and has only just launched a pilot.

Many think tanks and CBDC advocates globally believe exploring and launching a digital currency for central banks is essential to remain internationally competitive.

As more focus is put on the benefits and use cases of digital currencies such as bitcoin, ethereum, and stablecoins, pressure rises on central banks to provide a backed alternative.

The lab hopes to increase development in the area. FIS partnered with M10 Networks to create a suitable virtual area for nations to test their ideas. It supports over one million transactions per second at less than a second latency.

“The CBDC Virtual Lab allows central banks, commercial banks, and other financial participants to experiment with – and pilot – core concepts of issuance, transfer, redemption, offline payments, programmable payments, retail, wholesale and cross-border payments,” the company said in its announcement.