Today could mark the beginning of the end of the SVB saga.

After two weeks of desperate searching, the FDIC announced on Sunday that First Citizens Bank & Trust Company would assume all deposits and loans of the failed bank.

The 17 former branches of SVB will open today under First Citizens, leaving customers with continued access to deposits through their usual SVB branch. The FDIC has advised the customers to wait on further information from First Citizens on access to additional branches under the new company.

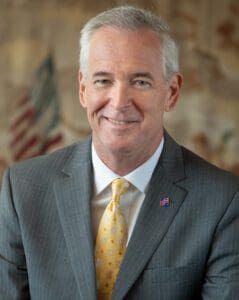

“This transaction leverages our solid foundation to add significant scale, geographic diversity, compelling digital capabilities, and, most importantly, meaningful solutions for customers throughout their lifecycle,” First Citizens chairman and CEO Frank B. Holding said.

“Specifically, we are committed to building on and preserving the strong relationships that legacy SVB’s Global Fund Banking business has with private equity and venture capital firms.”

On closure, SVB had around $167 billion in total assets and $119 billion in total deposits. First Citizen’s acquisition included purchasing about $72 billion of SVB’s assets at a discount of $16.5 billion.

This leaves the $90 billion in securities and some other assets that will remain in the FDIC’s receivership. The institution will also reimburse First Citizens 50% of losses in commercial loans over $5 billion, and the acquiring bank has entered into a liquidity facility if needed.

The FDIC has estimated the total cost of SVB’s failure to the Deposit Insurance Fund to be $20 billion. However, an exact price will be calculated at the end of the receivership.

Reactions are positive

Reactions to the news are mainly positive, with many preferring an acquisition of SVB to be carried out by another regional bank over one of the “big four.”

The market has responded with an initial price rally, although many say this rebound will likely be short-lived.

First Citizen’s acquisition leaves the rest of SVB Financial Group, SVB’s parent company, still up for grabs. This includes SVB Capital, with a venture portfolio of $9.5 billion in assets under management, and SVB Securities.