Fintech is growing so fast that F-Prime Capital is tracking it closely, principal John Lin said.

The independent venture capital group of Fidelity Investments, F-Prime Capital, has backed Atari, Ironwood Pharmaceuticals, and MCI from their offices in London, San Francisco, and Cambridge, Mass.

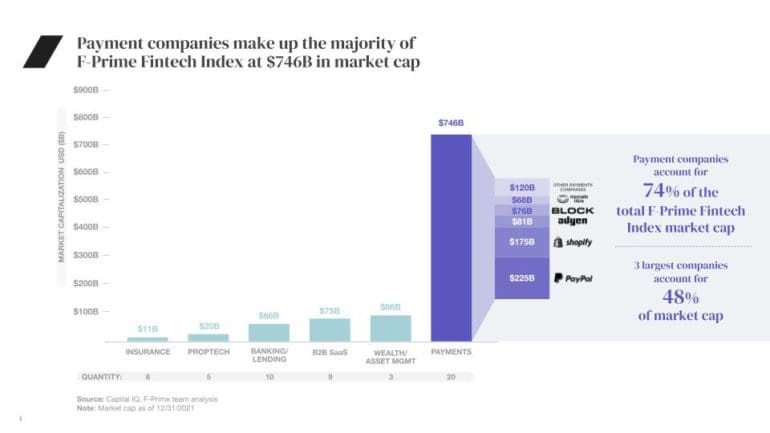

The F-Prime Fintech Index tracks the performance of emerging, publicly-traded financial technology companies.

Lin said it developed from the many conversations had in meetings about fintech trends. There were many fintechs and indexes, so why not blend the two?

The industry hit critical mass in 2021

Twenty-twenty-one was the perfect time to unveil the F-Prime Fintech Index, Lin said. The sheer number of companies in the space surged, and more of them were publicly listed. Some of those firms going public, such as Nubank, Robinhood, and Coinbase, were large entities. More than $120 billion was raised in private markets, north of 300 nine-figure deals.

“Whereas before, you might have had a few companies considered fintech companies. Now you have new companies entering the space that you’ve never seen before,” Lin said. “Ten years ago, you didn’t have any massive cryptocurrency companies. There were a lot of vertical SaaS companies 10 years ago, but most of them had relatively low revenue.

“Now, when you add things like payments, you get into these exciting new revenue streams. Toast is a perfect example of that. So, it’s a combination of more tech companies, more opportunities, and more VC money flowing into this space, along with new revenue models. You didn’t have that 10 or 20 years ago.”

SPACs had their role, but it wasn’t as large as some might think, Lin said. Of those fintechs that went public, 18% were through SPACs.

The velocity of exits into public markets is rising, producing higher revenue multiples and valuations. Public fintechs surpassed $1.3 trillion in market cap in 3Q21.

Payments dominant, but challengers lining up

In 2021, payments startups attracted more than $118 billion and made up 74% of the F-Prime Fintech Index by market cap. Lin said payments would remain strong, but several emerging areas will grab share, including cryptocurrencies, banking, and wealth and asset management.

AI technologies such as machine learning are becoming more prominent, though AI has been around as a concept for decades, Lin said. Credit the volume of data, cheap processing and server costs, the mainstreaming of AI, and the availability of off-the-shelf solutions.

“That’s why you start to see it in newer verticals,” Lin said.

AI affects numerous areas, Lin added. It can assist with lending decisions and combat fraud, BNPL, microloans, and wage payments.

Visual AI can help interpret more complex data sources and complement human decision-making. Data extraction from statements and bills is improving. Lin said he is watching the ability of AI-influenced systems to help with complex decisions like telling doctors when they can legally bill for services. Monitoring fraud in insurance is another example.

Payments still have space to innovate

Lin said there’s plenty to watch within payments. He’s seeing companies add a payment element to their vertical so they can participate in the payment flow. Embedded finance and the white-labeling of previously in-house technologies are some other examples.

Two companies he cited were Synapse and Plaid. As Lin spoke with companies about how they built their systems, so many discussed Synapse and Plaid that he invested in them.

“There’s this base layer of embedded finance that will begin to enable all these consumer companies and B2B companies to build on top of those companies and create more innovation,” Lin said.

Related:

Lin explained that this achievement came in stages, beginning with Stripe’s debut. The next step saw the Plaids enable greater access to more banking information, with lenders building on top. Then came Synapse, which let users create their accounts and move money. Creating credit and debit cards became easy and allowed non-financial firms to develop new revenue streams.

Expect even more innovation in this area, Lin said. There’s room to grow in providing richer information to merchants when a card gets swiped. Look for big players to open APIs.

Market maturing in unique ways

As the market matures, will there be more consolidation through acquisitions? The number of acquisitions is growing simultaneously as the total money in the space is doing the same, Lin said. Perhaps the overall percentage will stay roughly the same.

What’s changing is the types of companies making the acquisitions. The acquirers were large, well-known names in the past, but that has changed. Newly public companies, flush with cash, are making buys.

“You’ll start to see some of these larger acquisitions happen by smaller companies,” Lin said.

Emerging areas to watch

Lin said he expected most deal dollars to come from the United States, Europe, and Asia, but they don’t have a monopoly on interesting trends. He sees enormous potential in Latin America, Africa, and Southeast Asia. Each area shares some traits with the US but also has significant differences.

They likely do not have a traditional credit card and payment system, bringing lucrative opportunities. Because labor is cheaper in those areas, companies can perform manual operations too expensive in the U.S.

“Many of these areas are mobile-first as well,” Lin said. “So whereas maybe you use the check, your credit card or your bank account on the computer, people in many these countries have their credit cards and all their files on their mobile phone. And you can get access to information a lot more easily.”

Mobile-dominant banking also eliminates asking users for permission to go through multiple banks. They transact through text, so companies can discern patterns as long as they permit to read those. It eliminates the need for much of the infrastructure required in the U.S.

What makes Latin America hot?

Latin America is a large and growing market, Lin said. Whereas the U.S. has a market-dominant player in most sectors, the playing field is wide open in Latin America.

That has attracted many Latin American entrepreneurs who studied at top American universities and knew the intricacies of dealing with local governments and navigating the culture.

“There’s an opportunity to take what worked well in the US and apply that to Latin America,” Lin said.

Data privacy is considered on a company-by-company basis, Lin said.

One exciting area he said is the cataloging of permissions and controls so companies can track access and limit it to only those who genuinely need it.

If someone hasn’t accessed a database for a year, perhaps they don’t need access. The group becomes smaller, and a potential hacker access point is removed.