A multi-country consortium of European identity experts developed a comprehensive cross-border payment solution.

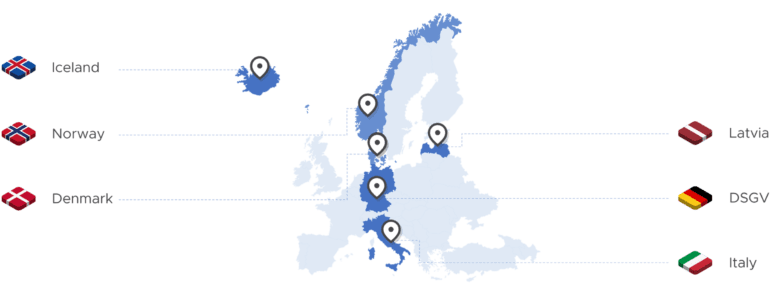

Designed to complement the European Commission’s digital identity wallet program, the Nordic-Baltic eID Project (NOBID) is leading a consortium of six countries: Denmark, Germany, Iceland, Italy, Latvia, and Norway. As part of the project, six countries will participate in a cross-border payments pilot aligned with the aims of the EU’s digital identity wallet program.

Financial services players support NOBID’s proposal, including DSGV in Germany, DNB and BankID in Norway, Nets in Denmark, Intesa Sanpaolo, PagoPA, and ABILab in Italy Greiðsluveitan in Iceland.

The consortium has several technology partners, including Thales, iProov, Signicat, RB, Aukenni, IPZS, Poste Italiane, Intesi Group, InfoCert, FBK, and Latvian State Radio and Television Centre.

iProov is part of a new multi-country consortium of Europe’s most trusted identity experts working on the proposal. Andrew Bud, CEO and Founder of iProov said, “We are committed to its vision for an inclusive and secure way to help citizens make payments. The success of the EU Digital Identity Wallet will depend largely on citizen adoption and usage. iProov provides simple and secures remote enrollment and authentication, which will be crucial to this goal.”

Europe and digital IDs

According to the European Commission, only about 60% of the EU population in 14 Member States can use their national eID cross-border.

Only 14% of critical public service providers across all Member States allow cross-border authentication with an e-identity system, for example, to prove a person’s identity on the internet without needing a password. The number of successful cross-border authentications per year is minimal, though on the increase.

However, using the European Digital Identity, the user only has to select the necessary documents stored locally on his digital wallet to reply to the bank’s request. Then, verifiable digital records are created and sent securely for verification to the bank, which can continue with the application process.

What does it give citizens?

It gives citizens access to public and private services, checks their ID electronically, and securely stores sensitive information. The consortium’s proposal focuses on payments, one of the four top priority use cases in the EU’s digital ID wallet vision. Payment issuance, instant payments, account-to-account transfers, and in-store and online payment acceptance would be possible using its implementation through the existing payment infrastructure.

It was initiated under the umbrella of the Nordic Council of Ministers, the project was developed. It works to harmonize the eID solutions in eight Nordic and Baltic countries and collectively adopt the eIDAS regulation.

According to the consortium, to evaluate each Consortium proposal, the European Commission will use the following metrics:

- “Number of wallet-issuing countries involved in the project

- Number of wallet users involved in the project

- Number of relying upon parties having integrated interfaces to the wallet in their pre-production systems

- Number of issuers of EAAs, QEAAs, and credentials having integrated interfaces to the wallet in their pre-production systems

- Number of wallet transactions completed in a pre-production environment

- Where relevant for the proposal, the number of qualified electronic signatures issued by users of the wallet.”

The payment use case

For the consortium, “the payment use case is recognized as a key use case based on several rationales, one being the potential extension to the Digital Euro.” Instant payments and traditional account-to-account transfers are used in the use case based on existing bank payment infrastructure. With the solution, strong customer authentication and transaction linking will be performed in line with other requirements, using the inherent features of the wallet.

For the solution to work, the intended recipient, who may be a business or an individual, must submit a payment request. This application will support several modalities, such as QR codes, push notifications, and deep linking.