The concept of embedded finance isn’t new — think of a private-label credit card offered by a department store — but the modern distribution model that marries financial services with an established business’s sales environment is emerging as a global payments force.

That’s the primary takeaway from a January report by DECTA, a global payment processing firm used by more than 2,000 companies in 32 countries, which suggests shoppers in many demographics are embracing and demanding better embedded financial services.

“I think that’s what makes concepts such as embedded finance interesting and exciting at the moment: the technology is finally catching up with them,” said Scott Dawson, head of sales and strategic partnerships for the London-headquartered DECTA, which provides merchants, banks and payment service providers a complete range of digital services.

In examining embedded finance’s several facets, DECTA researchers gave several takeaways on what firms can anticipate as applications of it continue to evolve. They include high demand for the availability of a customer’s preferred payment method and the speed and ease of the experience.

“When you look at the data that we have disclosed, consumers care about this, and it is a change in the payment ecosystem,” Dawson said. “It is actually affecting conversion rates, consumer confidence, and such. I think that’s quite interesting and quite important.”

Room to grow for embedded finance

The report concludes the market for embedded finance, while somewhat established already, still has room to grow. Embedded finance reached revenues of $20 billion in the US in 2021. Estimates say that figure will double in the next three to five years.

DECTA conducted separate surveys in the U.S. and the UK with 1,504 respondents, consulting with British online shoppers aged 19-68 and their U.S. counterparts aged 23-68.

Among the responses, 85% of Britons considered the availability of a preferred payment method ‘very important.’

Another finding was that 49% of respondents from both countries indicated they would abandon a purchase if their preferred payment method were unavailable.

The surveys found that a better checkout design can lead to a 35% increase in conversion rates for large e-commerce sites. Also, most respondents — 54% in the U.S. and 52% in the UK — considered having a same-page checkout experience when they purchase a very important or critically important issue.’

Other key findings in the report:

- Fifty-four percent of Americans said embedded add-ons such as insurance or financing are either very important or the most critical factor for a positive purchasing experience.

- Personalized offers are a positive, but not essential, extra financial incentive that can be improved by targeting other demographics.

- Streamlining the customer experience is a $213-billion opportunity: In the U.S., a website that requires a customer to log in was the second highest-rated source of a negative experience. Almost half of the respondents reported they would likely abandon shopping if they were required to do it.

‘Frictionless’ online shopping expected

Overall, Dawson says that customer expectations for a fast, trouble-free, and ‘frictionless’ shopping experience are high as technology evolves.

According to the report, real-time payments increased globally by 41% in 2020 alone. The technology is becoming more critical in key emerging markets such as India, which registered 25.6-billion transactions that year.

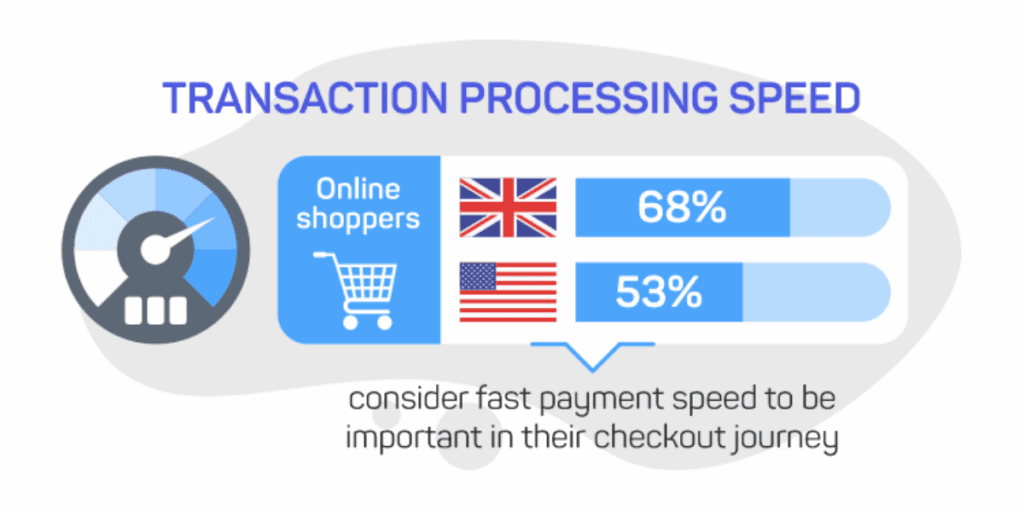

Among British respondents to the survey, 68% said the speed of payment is ‘the most important’ or ‘a very important’ feature for a positive customer experience. In the U.S., 53% felt fast payment clearing speeds are important.

“I suppose it comes down to is: the hallmark of true progress is people stop noticing and appreciating it. Take that (into mind), take a step back, and debundle it,” Dawson said.

In the 21 years he’s been working in the payments industry, Dawson has seen the technology and payment experience customers today take for granted evolve from its rudimentary digital dawn.

“Twenty-one years ago, you’d be lucky if an online service could take online payments directly,” Dawson said. “Then, when those online services began taking payments directly, you’d be lucky if it had the payment methodology you wanted to use. When they did have the payment methodologies you want to use, you’d be lucky if they were storing and using your data securely that didn’t involve unethical use of your details.

“All these small steps have happened over the last 20 years or so where suddenly — if a transaction takes more than 12 seconds — people can get quite upset.”

Today, a customer’s online shopping experience has evolved to the point where “these things that have taken years to be developed — and that have had so much thought, so much regulation and so much development put into them — are now standard,” Dawson said.

“We don’t even notice it.”