The following is a guest post by Tom Bell, CEO of Maast.

Digital payments have won. Widespread adoption of innovations like tap-to-pay, mobile wallets, and buy-now-pay-later have removed friction at the point of sale for merchants and their customers.

With cash already on the ropes, the COVID-19 pandemic dealt a decisive blow as more small- and medium-sized businesses (SMBs) realized the urgent need to get online and pushed their customers to digital payments.

Today, 82% of Americans use digital payments.

A recent survey from Gallup showed that a similar number of Americans use cash less than half the time (11% said they don’t make purchases with cash at all). I can walk around my neighborhood and find more than a few bars, restaurants, and retail stores with “Card Payments Only” signs in their windows.

On a recent West Coast trip, I asked the hotel concierge where I could get cash to tip a valet. His reply has stuck with me: “Unfortunately, we do not have any cash on hand, nor do we accept cash as a form of payment.” Almost everyone I know has a similar story.

With the cash economy in retreat, you’d naturally expect payment industry growth to level off or perhaps keep pace with population growth.

Instead, it’s expected to grow over 14% per year. Why is that happening? For one reason: Embedded finance.

It’s about more than payments

Digital payments opened the door for embedded finance, but the concept continues expanding.

Today, it encompasses a wide array of solutions.

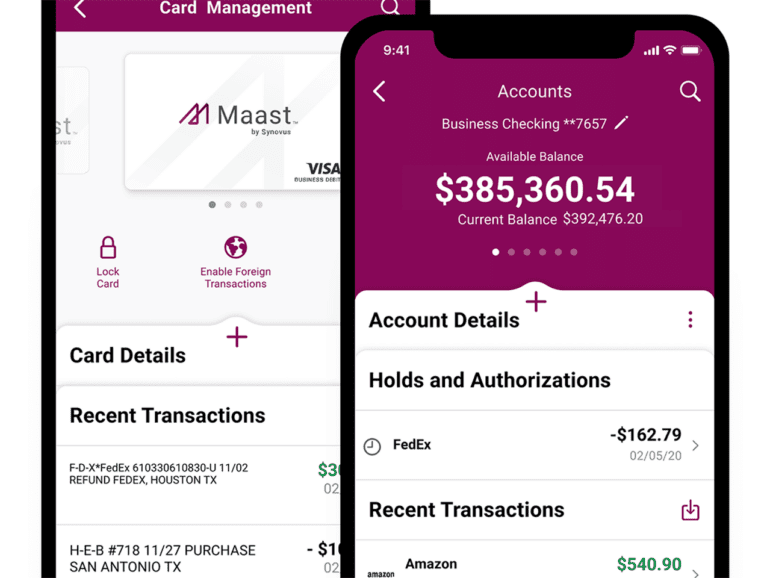

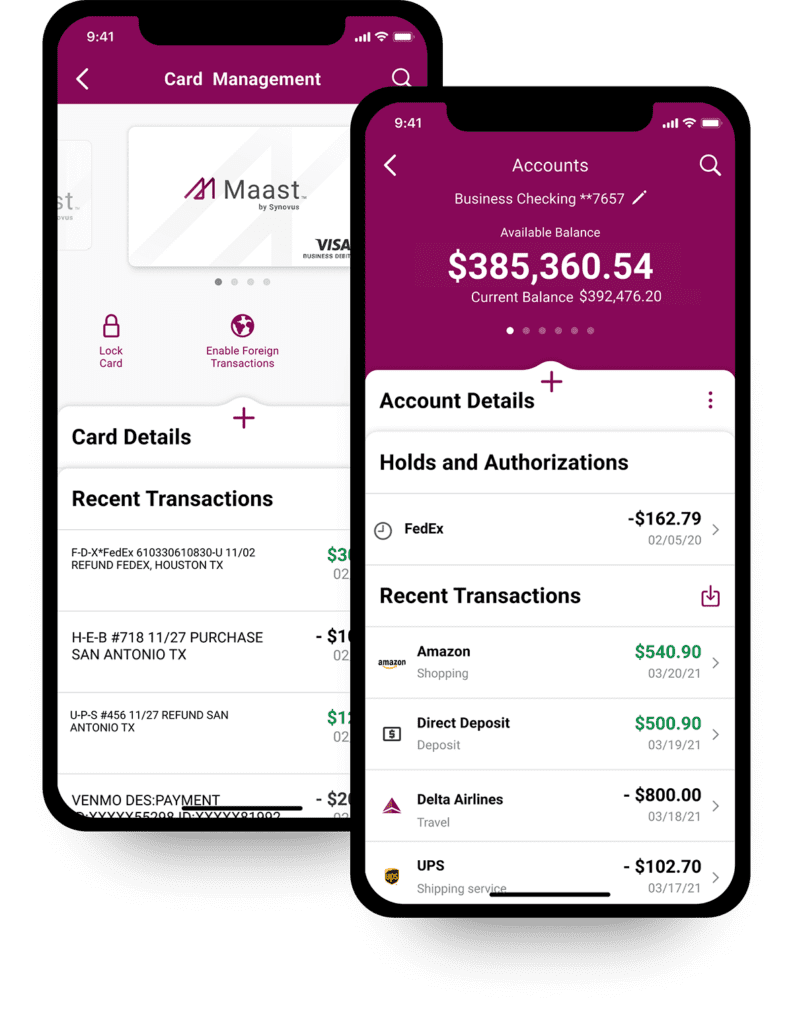

Forward-thinking fintech leaders are leveraging the opportunity to introduce more advanced services, including direct debit ACH, business checking and savings accounts, and more.

They’ve found an especially receptive audience in Independent Software Vendors (ISVs) and other Software Providers.

SMBs across industries rely on software as their technology backbone.

Related:

For example, a music store may depend on multiple applications from different software companies to track inventory, schedule lessons, and manage repairs.

Software providers can now embed an all-in-one suite of banking services into their platform, empowering the music store to bill their students, collect a payment from the Apple Wallet, and deposit the funds in their business checking account without leaving their virtual “home.”

This provides an immense benefit to the 88% SMBs who say that seamless banking experiences are important, very important, or required.

Why software providers are a perfect match

The appeal of embedded finance lies in how software providers can integrate features like merchant services, business checking, and more into their platforms without redirecting users to a financial institution.

For the customer, a seamless, white-labeled experience under the ISV’s brand can help reduce the need to toggle between different websites and programs – for an average employee; this could mean almost 10% more time to focus on getting the job done.

At the same time, the software provider unlocks powerful new revenue streams, such as value-added income from their customer’s payment and banking activities.

ISVS must find the right partner to implement embedded finance solutions that can evolve with the needs of its customer base and understand the complexities of payment acceptance and banking.

Software providers exploring these features should prioritize three considerations:

- Does your prospective partner align with your goals? Evaluate your current tech stack, product roadmap, and customer base. The right partner will help you upgrade quickly, seamlessly, and securely. They’ll provide a single integration and take control of underwriting, compliance, security, and support so you can focus on your core business and serve your customers better.

- Are you both invested in your success? Value-added services like embedded finance represent a powerful profit opportunity for software providers. Apple earns 22% of its revenue from Apple Pay, the App Store, and other supplemental sources – not hardware. Software Providers should look for a partner willing to share embedded finance revenues.

- Are they on the bleeding edge of risk management? As business software focuses more on individual industries, a key differentiator will be whose ear is best attuned to their customers. A singular focus on the user experience shouldn’t compromise critical data security and protection concerns. The right embedded finance partner should offer institutional-grade compliance and risk management.

The digital payments industry has won the war over Americans’ wallets, and now it’s winning the battle for the hearts of the nation’s merchants.

If payment acceptance and merchant services providers want to see continued expansion and not fight each other tooth and nail in a commodified market – it’s essential to continue innovating.

Embedded finance represents the clearest and best path forward by making user experiences simpler, safer, and seamless.