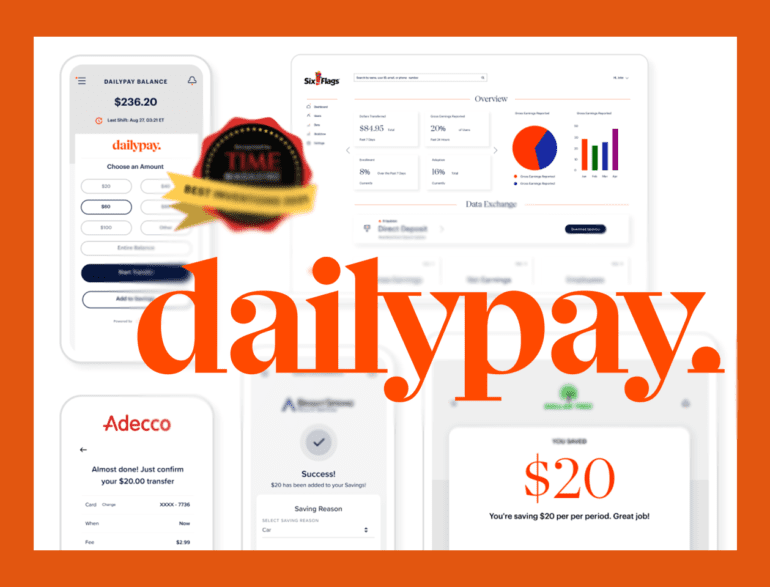

On Wednesday, DailyPay launched a reloadable prepaid card powered by Visa and Bancorp Bank for on-demand paycheck spending.

Employees that work at one of the hundreds of DailyPay-powered companies can access their wages the day they earn by loading them onto a spending card called Friday.

It is the first minor step toward holding customer deposits in a DailyPay app, a new product that makes it easy for customers to view and use their earned wages fee-free, Chief Innovation and Marketing officer Jeanniey Walden said.

“This enables anybody that works at a company that offers daily pay to have access to a card that they can reload,” Walden said, “and now you know what’s unique about it is since it’s connected to daily pay, you can access your pay as you earn it on this card.”

Anyone can have a card, sometimes their first

In a high-tech world and heavy inflationary environment, holding a card and getting cash flow or access to some payment options has become vital. She said that Friday could be saved onto mobile wallets like any other card.

“If you are underbanked or unbanked, especially in today’s world, you need to have a card, and so you know it works with Apple Pay, works with Google Pay, works with Samsung today,” she said. “If you are on a plane and do not have a card, you’re in trouble; you’re going to go hungry.”

Before the new product, DailyPay offered next-day payments through partnered employers and a $2.99 “ATM fee” charge for a same-day withdrawal. With Friday, Walden said there is no fee to load earned wages up and buy groceries the same day you earn, and said the testing data from beta users showed most people were using the card to buy groceries.

“So instead of transferring money from your daily pay account into a different account onto a credit card or not having a card, your money can just go on to the Friday card,” she said. “It’s really powerful and enables people to then just walk into a convenience store or a restaurant and just put a card on the table and just, you know to be able to live their life like everybody else.”

The new product also lets DailyPay offer in-app cash management for the first real-time, instead of a direct deposit early system that would send money out. For a growing product ecosystem, deposits are big, but Walden said it is not an official push toward the consumer fintech banking or deposited space.

But she did say it was good data to have, and customers were using the card option as a short-term credit choice.

“We’re starting to see people with other bank accounts putting money onto this card to supplement the money that they’ve made, say $150, to buy something that’s $300,” she said.

Transparency and transition

DailyPay partnered with hundreds of employers as partners, including Target, Adecco, Berkshire Hathaway, Dollar Tree, and many others, which translates to millions of eligible employees having access to the program. Walden said with gas prices this high and an imbalanced labor market, employers are looking for ways to get talent in the door.

She said that financial tools like earned wage access are a great way to do it, especially when employees are underbanked.

Walden said DailyPay has been taking advantage of this transitionary market and has experienced some internal changes as a company. They had a CEO transition and welcomed Kevin Coop in June, with a strong background from Dun and Bradstreet.

“Friday exemplifies DailyPay’s continued focus on delivering modern pay strategies that improve the lives of our users,” said Kevin Coop, CEO of DailyPay. “With Friday, DailyPay users have more flexibility and control over their financial futures than ever before.”