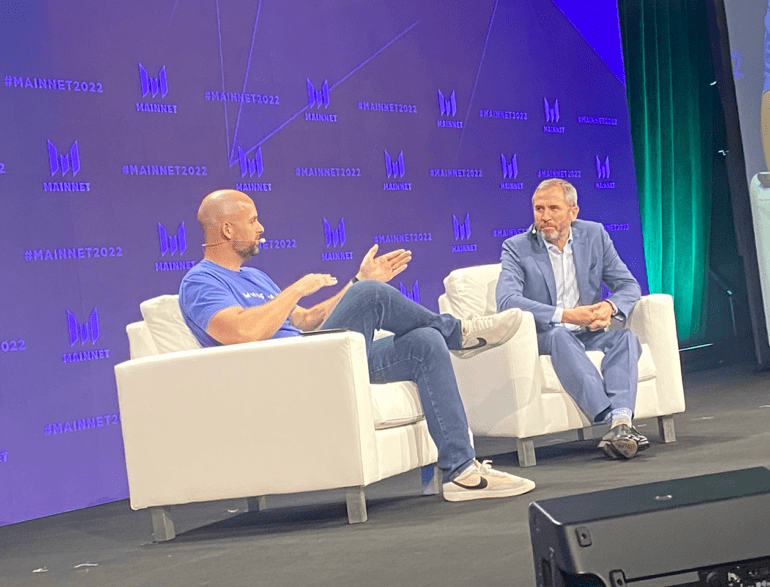

Ripple CEO Brad Garlinghouse told the audience at Messari’s Mainnet conference in New York City that the SEC could no longer push the crypto industry around if the invasion was to move forward.

Garlinghouse led one of the main keynotes that brought institutional crypto heads together in a warehouse that hosted the Van Gogh immersive art exhibit.

Mainnet: Crypto and the Fed

As Garlinghouse pointed out, many other crypto companies were looked over by the SEC, and that only Ripple could shoulder this fight on behalf of the industry at large.

“What does the judge say today? We don’t know, but I think the case will be in front of a judge,” he said. “I don’t think there needs to be a trial; the government and Ripple are saying we don’t need a trial.”

In a riveting conversation, Garlinghouse discussed the Howey Securities Test and the upcoming lawsuit hearing date, which he predicted would come from two to nine months before a judge.

“The fact is the SEC has the burden to prove that there’s an investment contract, and if there’s an investment contract, then you apply the Howey Test,” he said.

“I don’t think they can get past the investment contracts. But if they plan to test, they will fail because many people buy XRP who have never heard of Ripple. The idea that XRP is the security of Ripple, I think, is nonsense.”

Cryptocurrency needs regulation, and it has it

Garlinghouse, like many surveyed at the conference, contended that the cryptocurrency industry in America could only succeed alongside safe regulation and already feels the power of regulators.

“Projects in this room know this, Ripple is regulated by FinCEN, regulators in New York, and Federal regulators,” he said. “We have to get a bunch of licenses in this country. Gensler goes out there trying to portray the industry, using the phrase ‘Wild West.’ I don’t think this is the Wild West at all for those in the industry.”

He agreed there was volatility but said most people in the industry want to follow the rules of the road; they just need clear rules.

“Gensler adds confusion to the situation, like going after a former Coinbase employee for insider trading securities, but not going after Coinbase, going after the individual for trading unregistered securities,” Garlinghouse said. “It’s a [expletive] way to protect investors.”

Though contending Ripple was not selling securities, he did say that one of the SEC’s tenants is to protect investors. The day they announced the lawsuit, “$15 billion was evaporated in the XRP ecosystem,” he said.

On Wednesday, Garlinghouse said during DC Fintech Week that he expected an answer to the lawsuit from the SEC by the first half of 2023.

At the end of the talk at Mainnet, Garlinghouse encouraged the audience to reach out to their regulators and representatives to ask for clear guidance,

“We need more clarity,” he said. “We can’t let the SEC run roughshod over this industry in the United States.”