There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

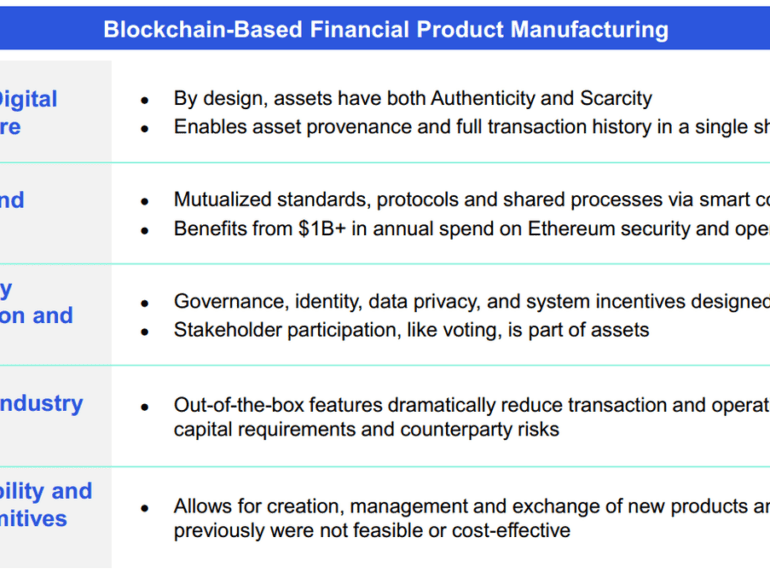

But nothing feels fundamentally different. Yes, we have some new brands that live on our phones. But when sliced across deposits, volume, or assets under management, the public companies still do the lion's share of the financial work. With open banking, incumbents are likely to win even more, powering Apple's credit card for example. The core reason for this, I think, is that Fintech has democratized access to existing financial products. It has not really changed how those products are manufactured. Only by transforming how things are made and the value chains to deliver them can you build the Google, Netflix, Spotify, or Uber of the next generation.

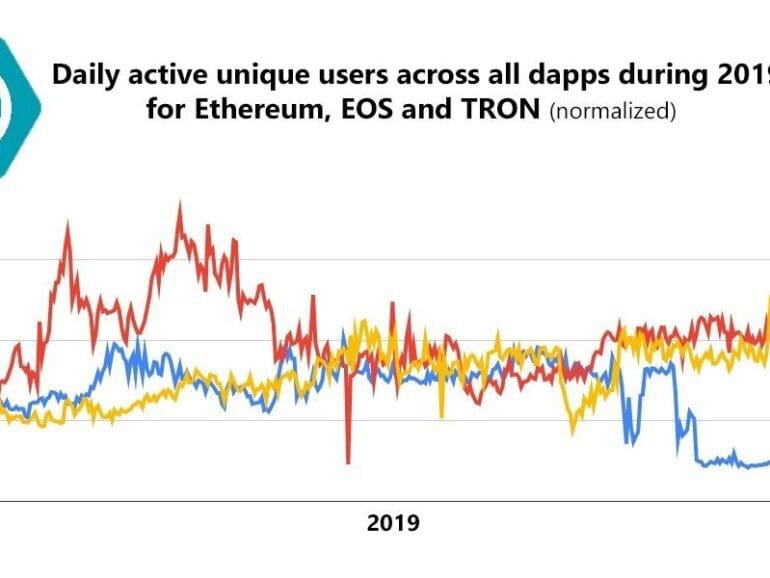

I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

Blockchain progress through the lens of Binance’s $180MM profit and Greensill’s $1.5B SoftBank raise

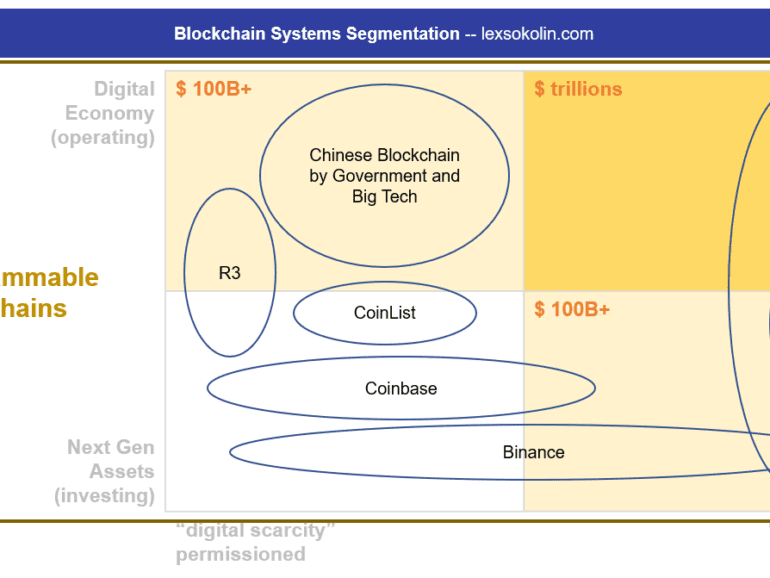

Look at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

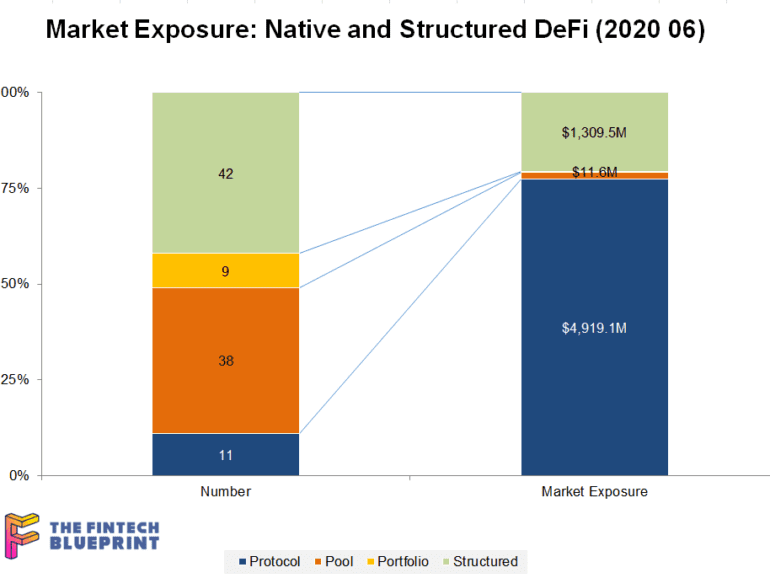

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

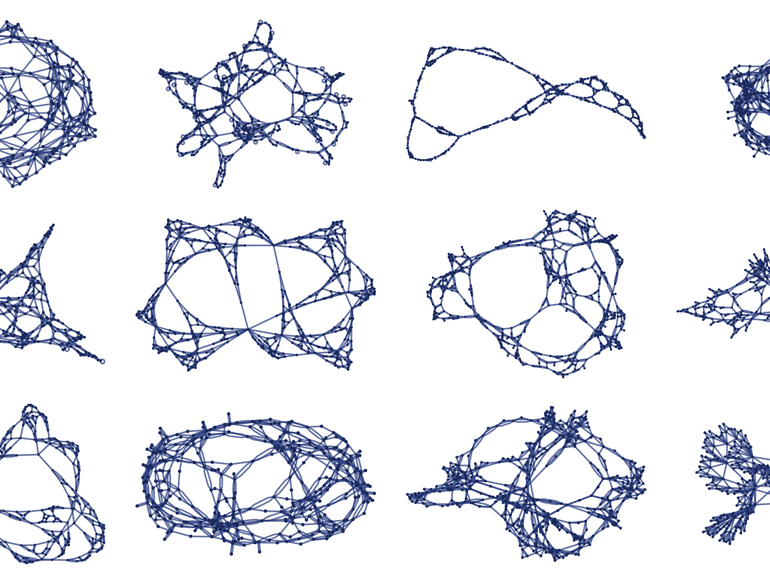

I came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

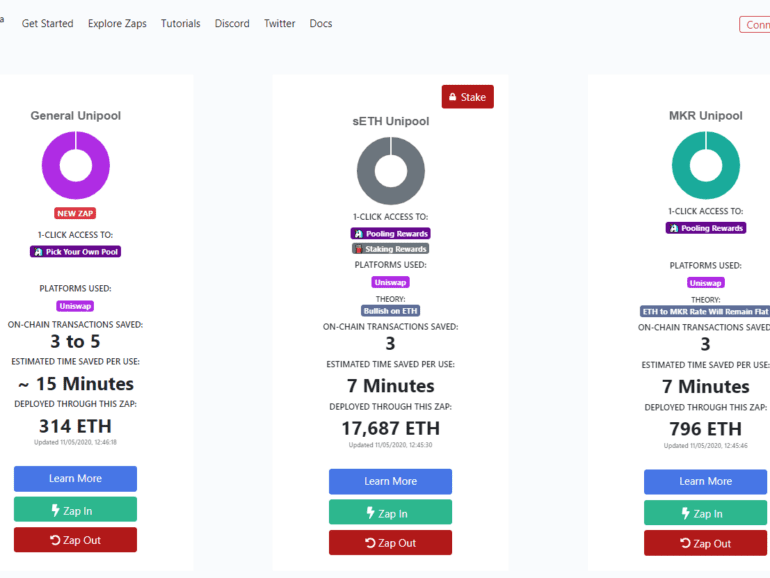

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

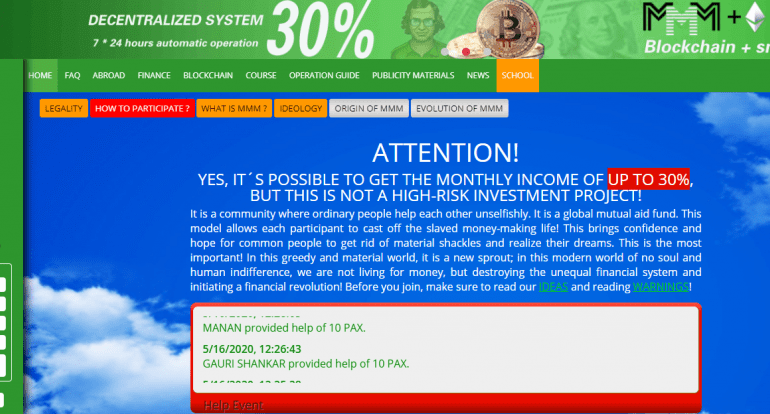

Let me introduce you to MMM. While decentralized finance and digital asset companies bend over backwards to be customer centric and reform financial services (each in their own way), MMM is a pretender. It is a pretender that has stolen the language of the crypto economy to create a cancer in its body.