The UK’s financial resilience is on unstable ground.

The rising cost of living has taken its toll on an already rocky outlook, bringing many closer to the brink of poverty and increased debt. Many are concerned that conditions will likely worsen before they get better.

“It is a tough climate,” said Clare Gambardella, Chief Customer Officer at Zopa. “Brits are undoubtedly facing challenges with their financial resilience.”

“Recent FCA data from October showed one in four adults are in financial trouble or at the brink of difficulty, while ONS data from the same month found almost half of adults who pay energy bills and 30% paying rent or mortgages say these are difficult to afford.”

“Financial concerns are resonating with more people than in recent years due to inflation and increasing interest rates. With this, more people may be looking to borrow money and use credit to manage to go into 2023.”

Jeremy Hunt’s Autumn Statement confirmed the UK has entered into recession, news that came as no shock to those already feeling the squeeze. Food price inflation is said to have reached a new high of 12.5%, energy rates are rising consistently, and economic growth remains at an all-time low. Schemes set out by the statement have done little to raise the public’s spirits.

Making savings work harder

In light of worsening conditions, many are looking at ways to improve their financial position. While some are turning to credit to ease the load of increased costs, the finance industry is shining a light on savings that could improve individuals’ financial resilience.

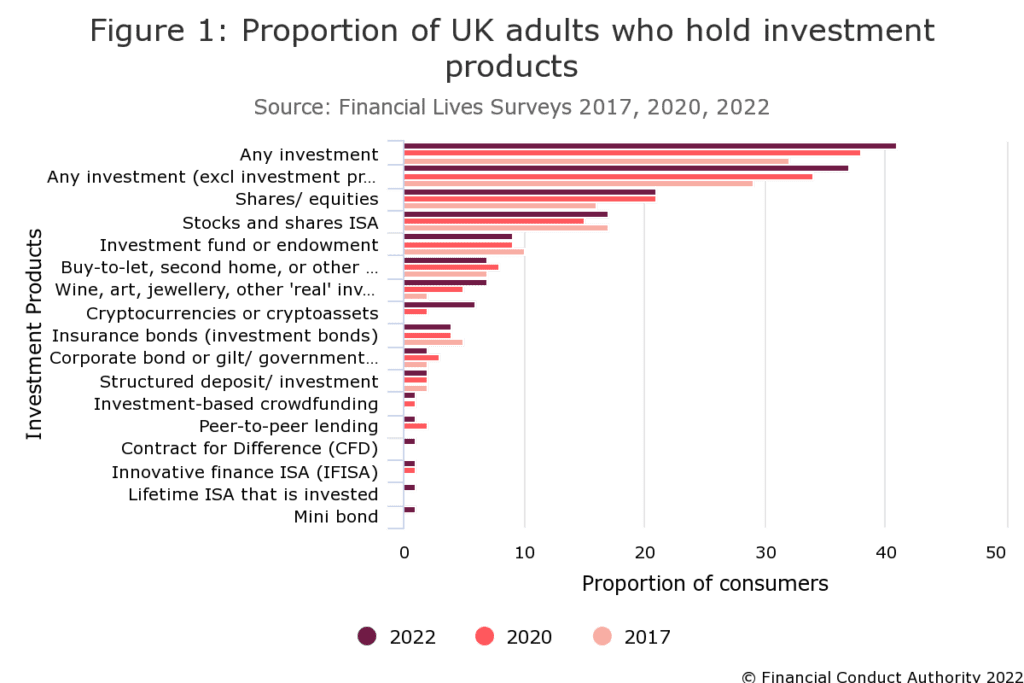

According to a survey commissioned by the FCA, most UK adults with over £10,000 hold 75% or more cash. While investment has risen in the past five years, cash savings continue to make up the majority of individual wealth.

“£300bn is currently sat idle in accounts paying little or no interest, meaning people are losing out on their savings by not switching to a higher interest savings account,” commented Gambardella.

The FCA found in its survey that many adults would like to invest this cash, but lower-income individuals are unlikely to turn to professionals for advice. In response, they have launched a consultation on improving access to financial advice for people to “invest with confidence.”

“Now more than ever, people across the UK should have access to useful and affordable financial products and services that can improve their quality of life and support the economy,” Sarah Pritchard, Executive Director of Markets at the FCA.

“These proposals are part of our work to deliver a consumer investment market where people can readily access support and firms aren’t deterred from providing it.”

The Fintech Pledge

Meanwhile, the fintech sector has been mobilizing to tackle the issue.

The International Monetary Fund published a paper in May 2022 that showed a correlation between fintech adoption and usage and an improvement in financial inclusion. Other reports have shown similar findings for financial literacy and wealth creation.

Aside from the multiple startup-turn-unicorns formed to address economic issues, many are banding together to reach common goals.

Zopa formed a coalition of fintechs in September 2022 to combat the cost of living crisis. In October, they announced partnerships with even more companies. The group was formed to push the Fintech Pledge campaign, aiming to improve the financial lives of 10 million people by 2025. Members of the campaign are either fintechs or enablers such as Google cloud.

“It’s vital that people look now at how they can make their money work harder and improve their financial position,” said Gambardella. “As we saw the cost-of-living crisis unfold, we felt that more needed to be done to help customers build their resilience and that the best way to do this was by creating a coalition of partners who could achieve scale and impact beyond that which we could achieve alone. That is why we developed the 2025 Fintech Pledge.”

“To determine where to focus our efforts, we looked at a range of data sources to understand the biggest challenges that consumers face right now and to identify actions which could have the biggest impact for them.”

“We chose the four pillars of saving, credit building, debt consolidation, and utility bill optimization, as we know improvement in these areas can often make a material difference in people’s financial resilience.”

While they recognized the government had been making steps towards easing conditions, they felt fintech had a critical role in speeding up the process. Initially focusing on consumers, they have alluded to the possibility of branching into other areas of the economy.