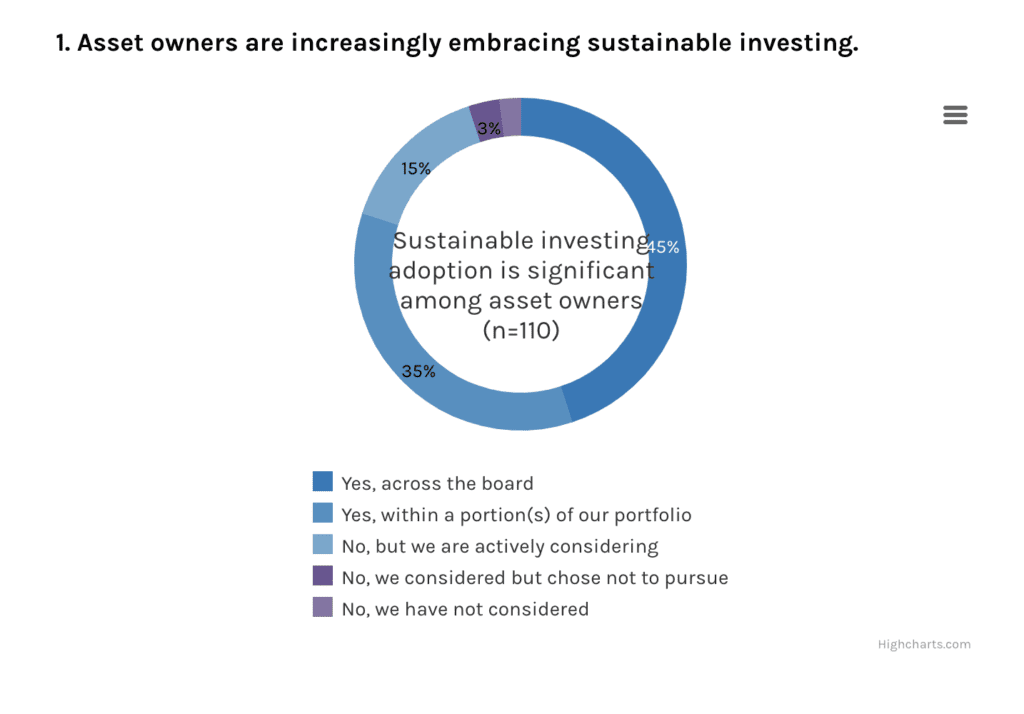

Sustainable investment appears to know no bounds. While the rest of the financial world has been hit by pitfalls, sustainable investing has grown by 15% in the past few years.

The World Economic Forum predicts sustainable investment is soon to become the norm.

As more of the world’s leading international regulatory institutions focus on climate change, so too does the public. Statements warning the world of irreparable damage due to the carbon footprint have caught the attention of even the youngest investors.

“Sustainable investing is growing in importance,” said Alex Lempka, CEO and co-founder of Connect Earth. “It is becoming more important than ever to allocate our funds towards companies actively decarbonizing their operations.”

A 2021 study by Morgan Stanley found that 88% of Millennials are interested in investments that address climate change. Furthermore, most institutional investors envision a time when they will limit allocations solely to investment managers with a formal sustainable investing approach.

Many are focused on the ESG risk element of their investment; how the businesses will be affected by climate change in the long term. Threats of drought and floods loom over certain jurisdictions, making the likelihood of their sustained success uncertain.

Others are interested in the impact the businesses they support have on the issue.

Whatever the reason, the need for transparency on environmental factors is becoming clear. People want to know if the money they are investing serves its intended purpose in supporting the values they uphold.

Providing sustainable investment transparency with an API

Connect Invest aims to shed light on the carbon footprint of investments.

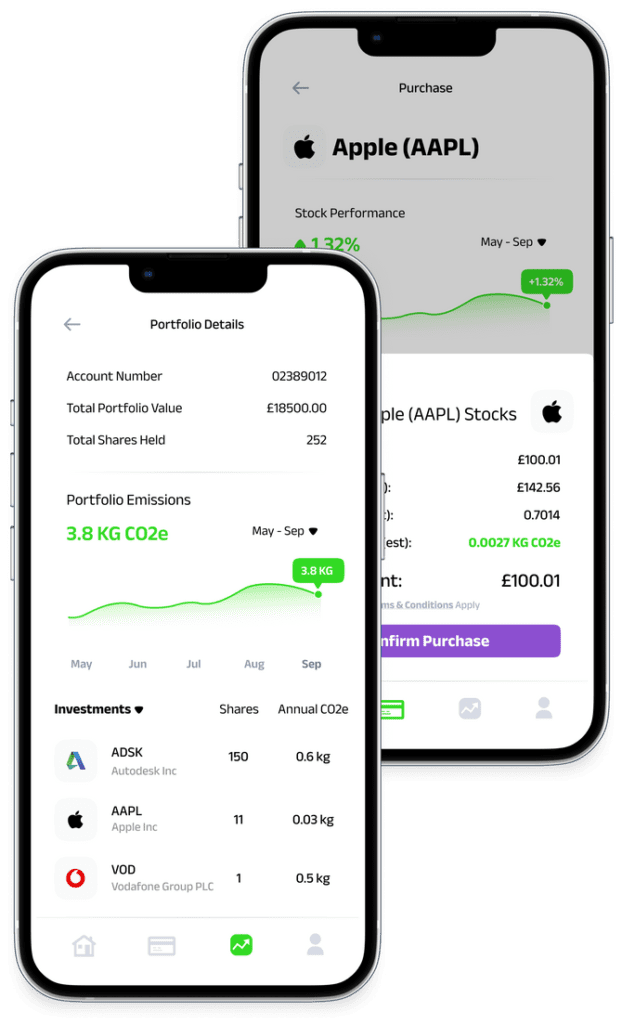

The API, developed by Connect Earth, uses data accumulated by the company to provide estimates on the stocks and shares of investors’ asset portfolios.

“Connect Earth’s new “Connect Invest” product can now empower the customers of financial applications to track the Carbon footprint of their investments in stocks & shares,” said Lempka.

The launch of Connect Invest follows the success of their Connect Insights product, which aids in carbon tracking for consumers to gauge the impact of their spending and change if they don’t run per their carbon saving targets.

The company states on its website, “You can’t improve what you can’t measure. Companies and consumers need to know where most of their emissions come from to reduce them.” The insights product can be integrated into any app, such as online banking, to help consumers keep track.

Like the insight product, the Connect Invest API aims to improve awareness of the impact of humans on the global carbon footprint. This time, however, it shifts the focus to the investor, targeting the powerful streams of finance that support international businesses.

The aim is to inform investors with the hope that, as public sentiment turns towards a more carbon-neutral future, they will redirect cashflows to more sustainable initiatives.

“Sustainable investing allows investors to use their money to create change and positively impact the environment,” stated the company. “Understanding the carbon footprint of an investment portfolio is the first step investors can take to address climate change.”

However, it’s not without its challenges.

Challenges abound, but the first step may be the most difficult

As carbon emissions data is still hard to come by, Connect Earth explained that investors find it challenging to build a balanced portfolio. “There are very few investments that are carbon-neutral or carbon-negative, and the carbon data of “regular” investments is not easily accessible,” they said.

“We collect this data from sources and standardize it within our database,” said Lempka. “The aim is to create APIs and toolkits to make it easy for anyone to build a climate change product.”

Connect Earth uses all the data available about sectors to make informed estimates on the carbon footprint a company may have. These estimates cut through the greenwashed noise that can berate investors wishing to make an environmental impact with their money.

“It’s tough to get this data,” Lempka continues. “What we have built internally is a proprietary data and science toolkit where we look at industry averages and proxies as well as company data. Sometimes it’s better not to include merchant data because a lot of the time it’s false.”

“The Greenhouse Gas Protocol recommends finding a hybrid between company data and proxy or category data, so that’s what we are working with.”

The Connect Invest API allows investment platforms to retrieve scope 1 and scope 2 emissions information related to each investment. As global regulation instills more requirements for businesses’ mandatory disclosure of these emissions, the API remains up to date and enriched with the additional information, helping it better serve those platforms that integrate it.

It also allows institutional banks and investors to evaluate their portfolios to help present more detailed sustainable investment options for their clients.