Comun recently announced the closing of a $4.5-million seed round.

The company is a neobank focused on offering financial inclusion banking solutions.

According to the company, the resources from this investment will be used to expand the reach of financial services for Latino immigrant families in the United States.

The round was led by Silicon Valley fund Costanoa Ventures and included South Park Commons and FJ Labs participation.

In the U.S., Latino immigrants are among the communities with the most difficult access to credit because many of these individuals generally do not even have credit scores – severely limiting their financial growth and social mobility.

Related:

Fostering financial inclusion

It is in this context that Comun seeks to make a difference.

“We built Comun to make it easier to thrive as an immigrant family in the United States,” says Andres Santos, co-founder, and CEO of Comun, in a statement.

“Banking is a gateway to access many vital services to a person’s livelihood. My co-founder and I experienced how difficult it can be to navigate the banking system as immigrants. Our goal is to empower families to succeed financially, and in the United States with a financial partner they can trust and understand.”

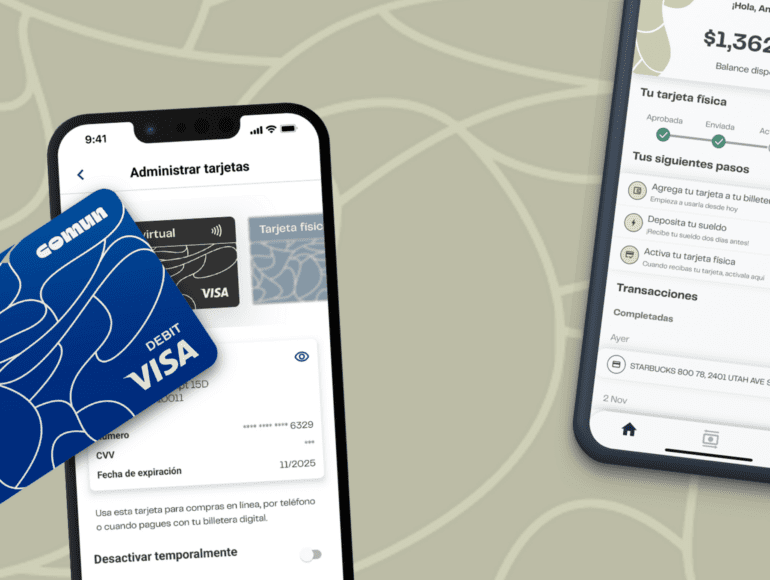

Comun eliminates the language barrier and gives Latino immigrants access to traditional financial services in Spanish, including a checking account linked to a physical and virtual Visa debit card, direct deposits for payroll, and free ATM withdrawals and deposits, but without requiring a Social Security number or additional or hidden fees.

A complete, modern digital bank Latinos

“There is a huge opportunity for financial products that better fit the needs of multigenerational Latino families in the U.S.,” Mark Selcow, a partner at Costanoa Ventures, says in a statement.

“People want their bank to understand them, and Comun is building the best, most customer-focused digital bank for a large and growing first and second generation of Latinos,” he stated.

Founded in 2021 by Abiel Gutierrez and Andres Santos, who faced financial exclusion when they immigrated to the United States, Comun’s customers already move more than $100K per week on average, with growth – according to data released by the fintech – of 20% week over week since its debut in September 2022.