Rampant financial crime is becoming a common theme of news stories.

High-profile scandals aside, the financial community is living under the ever-present threat of more sophisticated approaches to fraud, fraud-as-a-service, and general manipulation of financial tools for criminal activities.

It seems, along with macroeconomic challenges, criminals have decided now is an excellent time to up their efforts. Pwc found 51% of surveyed organizations had experienced fraud in the past two years, the most significant level recorded in the firms’ 20 years of reporting. Digital fraud attempts had increased by 150% in 2021, and money laundering costs 3-5% of the global GDP.

“The sad truth is that this kind of environment promotes people to become victims of financial crime,” said Iain Armstrong, Regulatory Affairs Practice Lead at ComplyAdvantage, explaining that now he is seeing similar criminal actions to those that surfaced in the aftermath of the 2008 financial crisis.

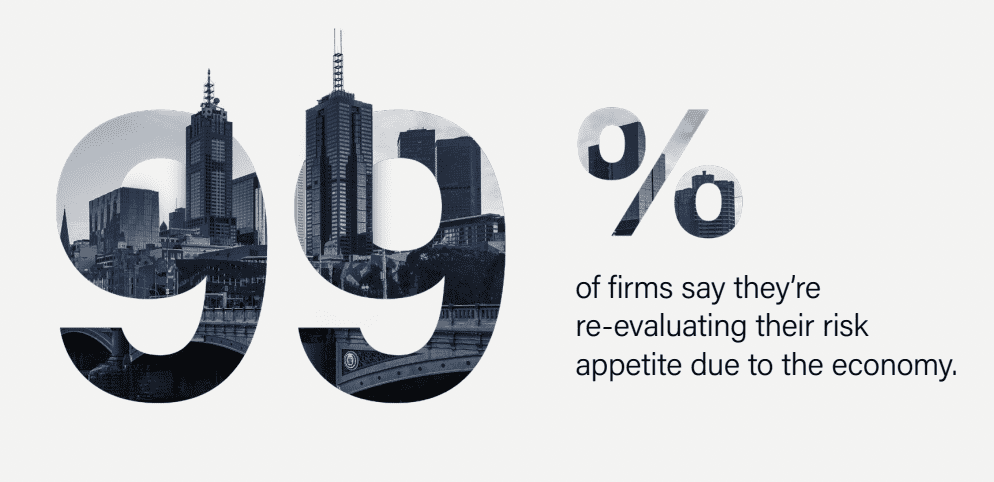

According to ComplyAdvantage’s 2023 State of Financial Crime report, financial crime is set to soar as economies falter. Companies are wary, 59% stating expectations of a further rise in crime levels, and 58% of compliance teams expect to hire to meet the expected levels. Around 99% are considering derisking in the current economic climate.

Firms aren’t the only ones jumping into action to stop the crime epidemic. Governments are also increasing efforts. Ever-evolving regulation efforts for crypto and AML are reportedly stepping up this year in a push to “police” illicit activity.

Why now?

Armstrong explained that through the uncertainty and desperation of factors like the pandemic and heightened inflation, individuals become more vulnerable to targeted scams.

“Suddenly, you’ve seen the value of your investments plummet. And the sad truth is that that can lead people to take bigger risks with their money,” he said.

In addition, the challenging environment has affected the criminals themselves.

“Criminals are impacted by global events just as much as anyone else,” continued Armstrong. “As a criminal, you need to look at new opportunities.”

Rising reliance on digital technology that is, in some cases, nascent (as in the case of crypto) has provided criminals with more alleyways to target the unsuspecting consumer. A lighthearted “official” message alerting you to a possible security breach can now turn into an attempted hack.

RELATED: Trust No One: The rising sophistication of digital hacks

Those in the business of crime make it their expertise to expose these weaknesses, and a shift to criminal “as-a-service” organizations has made the activity laser-focused and hyper-effective.

In addition, loopholes and weaknesses in anti-money laundering efforts have been exploited, leading to a maintained level of 3-5% of GDP being processed yearly.

“That number has been pretty much the same for the last 20 years,” said Armstrong. “Now, you could find that quite depressing. But that means the industry has just about managed to keep pace with the criminals because if they hadn’t, the number would have grown over time.”

While the industry may have kept pace, they also have yet to improve despite ongoing efforts.

Derisking and reassessing

While the landscape seems bleak, there are various ways companies can strengthen themselves against possible attempts at crime.

In the ComplyAdvantage report, 99% of respondents said they were re-evaluating their risk appetite due to this uncertain economic environment. Armstrong explained that while regulators had historically taken a dim view of wholesale “derisking,” it was an activity to which fintechs could be particularly susceptible.

“We expect, in the fintech community specifically, there will be a certain amount of derisking. Not in the sense of completely closing their doors…but I think I would anticipate that those firms will be a bit quicker to hit the off-board button.”

“I’d also expect that as a community, they will start to put tighter restrictions around the types of customers they’re willing to onboard. We’re likely to see that type of behavior a little bit more prominently in the fintech sector than we are in the incumbent banking sector- it’s a bit of a tightrope that they’ve got to walk.”

This could be particularly damaging in a climate where consumers are increasingly looking to fintech to help solve issues arising from macroeconomic conditions.

He explained that the derisking approach is limited, and three areas of businesses could be re-assessed to handle instances of financial crime better; People, Processes, and Technology.

People – “There’s a regulatory requirement to ensure that your staff in financial industries receive appropriate training around financial crime. So that’s one obvious area where you can do something straight away.”

Processes – “If you want those staff to be able to spot these problems, and you have to give them instructions, for if they do find that kind of activity.”

Technology – “This is the big one. There’s only so much you can do with written processes and well-trained people. If the technology isn’t capable of spotting these things, then you’re not going to get anywhere.”

“That technological problem is where I would be turning my attention if I were a fintech. You know, you have a limited amount of people, and in terms of bang for your buck in the long term, investing in those technologies is where you’re most likely to see improvements.”

AI could be a game-changer

Developments in AI are already proving to be practical tools in the fight against financial crime. Becoming significantly more sophisticated with machine learning integrations, their ability to determine and alert of suspicious activity is in an ongoing process of improvement.

For Armstrong, this could be a game changer.

“After spending the best part of 20 years just fighting this problem, you can feel like you’re on a bit of a treadmill. For every good thing you do, the criminals are quick to respond,” he said.

“The use of AI and machine learning is probably the single most promising development we’ve seen in this space for the time I’ve been working in it.”