International cross-border banking system SWIFT announced it was building integration with Chainlink.

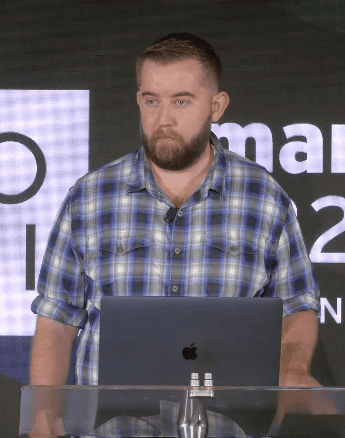

Chainlink Founder Sergey Nazarov set the stage with the news at the beginning of a Smartcon 2022 panel alongside Jonathan Ehrenfeld, Director of Strategy at SWIFT.

The integration will use Cross Chain Interoperability Protocol (CCIP), a Chainlink native standard of token exchange built for institutional use.

“I am happy to announce we are working on an initial concept with SWIFT on using CCIP in the capital markets,” Nazarov said, “to enable communications and movement of tokens in a way that will accelerate the adoption of CCIP and blockchains in capital markets.”

The announcement came last week as the Chainlink Foundation held Smartcon 2022, the startup’s first in-person of three web3-facing conferences.

Wake me up When Smartcon Ends

After an introductory keynote by Nazarov, launching the two-day conference on the Lower East Side in Manhattan, the SWIFT panel began. Nazarov took the stage with Ehrenfeld; Victor O’Laughlen, managing director and head of enterprise tokenization at BNY Mellon; and Stephen Prosperi, head of product management and Digital Securities Management at DTCC.

They covered how traditional finance financial instruments will co-exist alongside digital assets for the foreseeable future and how fintech is building bridges between them.

Ehrenfeld began by reminding the crowd of SWIFT if they had not heard of the international system before. SWIFT is used by thousands of financial institutions in more than 200 countries, providing a secure messaging system to facilitate cross-border money transfers.

The last time SWIFT came up on the Fintech Nexus News site was back at the beginning of the Russian invasion of Ukraine in February.

At the onset of violence, experts called out SWIFT as an option to sanction Russian money, and an international payments tool oligarchs could scamper down like rats fleeing a burning ship by its mooring lines.

On March 1, the European Union, the UK, Canada, and the U.S. agreed to remove several top Russsian Banks from SWIFT.

Now that’s what I call decentralization

Smartcon 2022 was a dev-con for Chainlink ecosystem builders. Many of the presentations on stage and in the trade hall were very developer-focused implementations of a decentralized oracle system.

However, the most significant news of the decentralized conference was the planned implementation of Chainlink-enabled cross-chain capability for traditional institutions through a traditional bank communication infrastructure: Decentralized helping out centralization.

As Web3 fanatics will describe, the future of the internet is a combination of Web2 and Web3 services where they are needed.

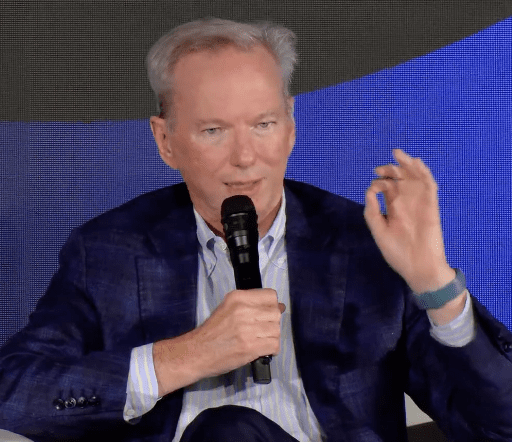

As a panel between Nazarov and Eric Schmidt, Chairman of Steel Perlot and former Google CEO, pointed out, Web2 will be built alongside Web3.

A self-described skeptic turned investor and Chainlink advisor, Schmidt described his belief that Web3 is the future of the industrial age if only the industry doubles down on scaling and builds solutions to problems we have with Web2, not replace Web2 with a decentralized cloud.

“I’m a skeptic because I believe in Web3 tech as the future; Trustless, immutable, and distributed,” he said. “but looking at the early tech, I didn’t think you could scale it.”

After seeing the progress of Layer 2 techs, using tokens on top of layer one to incentivize behavior, the room of listeners in front of Schmidt was ahead of the academics and skeptics; they are a part of the future.

But then Layer 2 came along, and everything changed

“We won’t, but if we make a new company, decide to use a new coin, we could set its value increasing directly with demand,” he said. “In my career, I have always had payment by valuations through stock options, and never was a token connected directly to network use: It’s a new way of tying the compensation and incentives to the scale of a network.”

He said economically, it makes sense to tie participants to network value to drive growth and adoption, and the tokenized nature of Web3 changes the game. But there are still centralization issues in Web3, as he pointed out with the simple miner example.

Before China shut down bitcoin mining, more than 50% of miners were safely behind the great wall, he said, and possibly could have voted for a different protocol consensus and changed the system if they had coordinated. Another problem Schmidt described is that most Web3 is hosted on Web2 services, like Amazon and Google Cloud.

“I keep reading these claims that Web3 will take down Amazon, Google, and Microsoft,” Schmidt said. “That’s unlikely; Web2 will be used in cases where you don’t need trustlessness for traditional web stuff, but if you need something that is trustless, immutable, and distributed for things like financial products. That’s Web3.”

Schmidt said that those problems will not hamper Web3 completely: many consumer apps will always run on a Web2 front end in the future. He advised the developer crowd: don’t worry that no one is as excited as you are; most people just want tech to work.

“For most consumer apps, the consumer will go through a Web2 interface, and Web3 is the service behind them,” Schmidt said. “Remember that as excited as you are with Web3 as a product, the consumer just wants it to work.”

He said by example to think about all the obstacles with using digital cash, down to physically using a card and taking out a mobile phone. The future goal should be to make digital cash completely seamless, he said, and that is within reach.

A lot on the line

He asked Nazarov how Chainlink would fix those problems. By offsetting computational power into an oracle network, Nazarov said, putting people’s faith in mathematics and protocols and less in people. The Chainlink team will provide the infrastructure, and it’s up to other builders to create great financial products.

“Cryptographic truth will always be the right answer,” he said. “People’s faith in mathematics will be stronger than in humans, institutions, and brands because the likelihood of mathematics failing is very small.”

But when faith in people or institutions fails or, worse yet, proves misplaced, they fail big, he said, like the 2008 financial crisis.

The type of tech Chainlink wants to introduce alongside SWIFT has the capability of becoming central to the economy, Nazarov and Schmidt agreed, and could cause 2008-level stuff. When it comes to bridges between blockchains, described by Vitalik Buterin as unstable, they have collapsed or suffered hacks all year. Binance suffered a hack to its BNB chain that cost more than $500M.

Schmidt closed the talk by congratulating the Chainlink community for being on the future-leaning side of the industry. The community was out in force at the conference, an online-only collection of fanatics that for years called themselves “Link Marines” that, in some way or another, stumbled onto the hexagonal coin and the promise of connection it brought.

As Schmidt described Google’s goal to take part in every single online action in at least some small way, Nazarov doubled with the Web3 version: as long as it ensured security and trustlessness.

He said that Chainlink would take part in every transaction in the future and build a market-to-trade data trust that everything uses.