Celsius, one of the largest crypto lenders, shut its doors to the public over the weekend, citing the dangers of market volatility and defi scams.

In one of his last appearances in public, CEO Alex Mashinsky talked to a Fintech Nexus track audience about bear markets and downturns.

“I guess the people here are the people who survived the 2022 crash? Is that a good question?” Mashinsky asked on a Web3 and crypto panel three weeks ago at the Fintech Nexus USA event. “Blood on the streets.”

His firm is under bankruptcy-level pressure as crypto prices collapse. They announced the shutdown in a blog post.

In Mashinsky’s own words, the platform allows you to loan out crypto for yield, swap coins, and generally onramp into the crypto world, with 2 million customers and $12B AUM (at the time.)

As bitcoin flirts with the $20K benchmark — the previous ATH in 2018, and the ‘point of no return’ for the never below last ATH narrative — Celsius has become one of many firms to run into margin calls.

After advertising greater than 18% returns for yield on the platform for a year, Celsius locked out withdrawals on the platform over the weekend blocking every user in the community’s interest, the firm said in a blog post.

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swaps, and transfers between accounts,” Celsius said in a blog post. “We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

Investors of all sizes at risk

Uncompromising news for Celsius holders: the lending network-centric coin dropped 50% in hours.

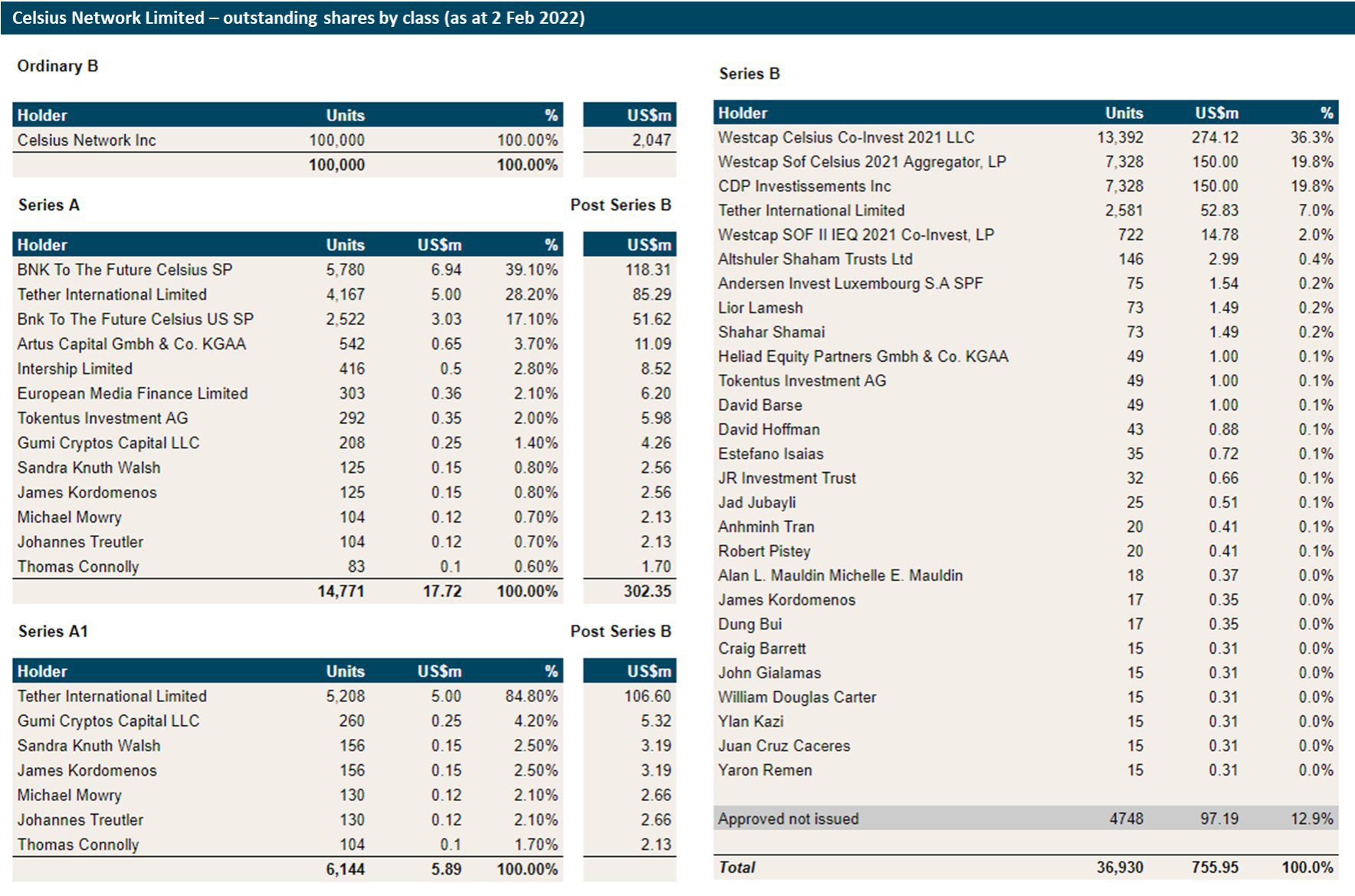

Celsius was a significant player in the crypto industry, with investors including a Canadian Pension Fund, the Caisse de dépôt et placement du Québec (CDPQ.) At the project’s valuation height, they raised $864.3M, with $30B AUM, cut to ribbons.

“We’re in a wave; whether you want to join the wave or don’t want to, the tsunami is coming. You can’t stop it, and you can’t do anything about it,” an enthusiastic Mashinsky said at Fintech Nexus.

“The fact you are in this room, you’re already wet from the tsunami, I’m sure. To grab the future, you must let go of the past, and you cannot grab the future and hold on to web two simultaneously.”

He described his lending company as a bank but using crypto. Calling himself the true Robin Hood, who takes to from the rich and gives to the poor, he said Celsius charges users no fees but instead lends out their assets to institutions and charges the big guys’ fees.

“We take from the rich and give to the poor, you know, so maybe I’ll change my name to Robin Hood; do you think that’s a good idea?” he asked the room. “Because they don’t do that, they don’t give their customers anything. It was just free trades.”

Over-leveraged vs. over-collaterized

Like traditional banks that make bad bets with over-leveraged collateral, Celsius has taken hits from its investments and watched as stakeholders dropped out.

Tether, the Bahamas-based byzantine organization that created the USDT “one-to-one” stablecoin, lent Celsius a reported $1 Billion and subscribed for a 7% stake during a Series B funding round. Mashinsky said his firm paid the loan back at 5-6%.

In response to what Tether calls “fud,” the firm released a scathing post of its own, stating its position with Celsius was safe and overcollateralized. On Wednesday, it was “liquidated” without any loss.

Celsius representatives and Mashinsky did not respond with further comments on the situation. For Tether’s stake to turn up liquidated on the balance sheet, Celsius would have had to pay out the remaining principal.

The firm is one of the largest custody holders in the consumer crypto space. It used institutional loans like tethers and consumer assets to lend themselves to crypto institutions and also ran into trouble there.

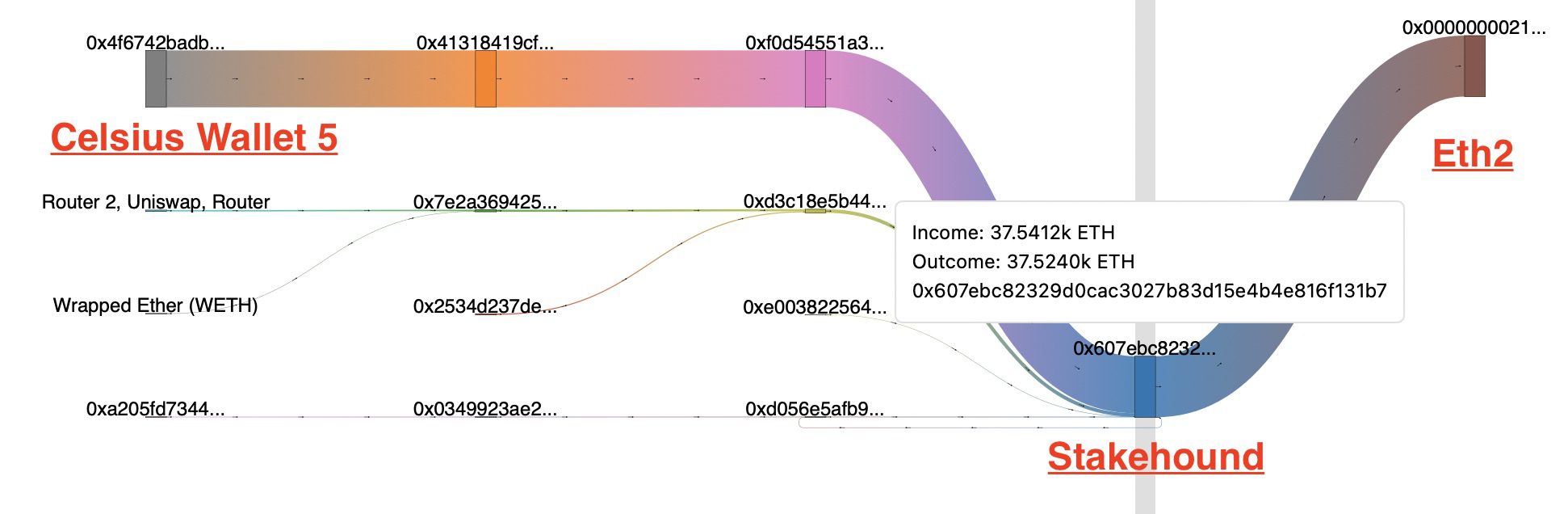

The Substack Dirty Bubble first reported that Celsius sent 35,000 Eth to Stakehound, a staking network that suffered a hack in 2021, losing Celsius millions. Celsius also lost out on the $54M they used with BadgerDAO, stolen out of a Meta Mask wallet during a $115M breach in the defi network.

Celsius also lent cash to Luna/Terra, though they self-reported that they got out safely before the great depegging.

There are other examples of cash crunch, where Celsius lent out funds that were locked up, stolen, or in the red.

Surviving stress tests

“Crypto goes through a stress test every year, sometimes twice a year; the financial system doesn’t. It goes through a spreadsheet-based stress test,” Mashinsky said at Fintech Nexus. “When the music stops every 10 or 15 years, we discover that we’ve all been swimming naked, as Warren Buffett said.”

Mashinsky said at the Fintech Nexus USA talk that regulators just wanted to hold back the future and that crypto is a tech platform that can build what comes next.

At the same time, crypto is not causing fraud and bad bets; it is just enabling them to happen faster, he said, and one day regulators will become a thing of the past. Speaking about the Luna crash, he said it is not representative of all crypto, just one lousy project.

“We’re here to create something that does not need a bailout from the Fed, does not need the handholding, and not leveraged 50 to one,” he said. “We must prove that we can deliver on what we’re promising. Luna is not representative of crypto. It’s just one idea that didn’t work out.”

During the panel, Mashinsky talked with panelist Ram Ahluwalia, formally at PeerIQ, current founder of Layer Zero Wealth. With moderator Helene Panzarino, Associate Director, Centre for Digital Banking & Finance at the LIBF, the triplet broached the topics of financial future as a part of the NYDIG-sponsored content room.

With a small crowd, Ahluwalia said that it was a good sign not that many people showed up; the market was reaching full bear and entered the fat-cutting growth stage it needed.

“An observation on the crowd: If this were standing room, it would be back in December, and it would have been close to the top of the market,” he said. “This is a good sign.”

“Are you calling a bottom?” Mashinsky asked.

“I’m definitely not calling a bottom.”

Recourse is coming

Ahluwalia, formerly in traditional banking and fintech banking at Cross River, suggested while the dust settles, regulators would start sharpening pitchforks.

“The libertarian part of crypto, which is all for decentralization and oversight, are relearning the lessons of the last 20 years and last two millennia around the role of banks and learning why investor protection and consumer protection regulations exist,” he said. “You have Mark Cuban buying a fraudulent NFT. Now he’s saying, ‘Can someone help me? Can someone protect me?’ You’re seeing people send transactions to wallets incompatible with their tokens, lose their funds, and there is no support desk, no recourse.”

Mashinsky said he was about to kick him off the stage, but Ahluwalia said he was still hedging his future on a crypto bet as a founder in the space. He just wanted transparency at the consumer level.

In response to some of Mashinsky’s claims, Ahluwalia said in his days watching fintech startups at Cross River, many high-growth firms would do anything to justify their next round of VC funding.

Anything for another round

“There’s that dynamic at play here, making unsecured loans prop up trading firms. What the heck is going on here?” Ahluwalia said. “There’s a reason why the Volcker rule was passed to protect customer deposits from taking prop trading risk. I think a lot of folks that are seeking yield put in deposits realize it’s not FDIC insured, it’s not may lose value, you’ve seen that it’s a ‘will lose value at some point in time.'”

The fed launched the Volcker rule after the 2008 financial crisis to keep banks from using their accounts to trade securities and derivatives or self-dealing bets with house money. In June 2020, the FDIC released the rules, allowing investment bank funds to flow more easily into VC.

In response, Mashinsky said that his firm would publish reserve information on the blockchain, demonstrating their departure from other crypto companies that only state the number of coins they are printing.

“Most people don’t understand that when you earn what they call yield on Cardano or some other project, it’s not yield; it’s just inflation,” he said. “They’re taking tokens in the treasury, giving them to you, and you’re saying, ‘Wow, I’ve earned 11%!’ You didn’t earn anything they printed, and their inflation is 11%.”

He said Celsius does not do that but instead pays out what the firm has earned by lending out consumer resources.

The idea comes from a good place

After bitcoin, eth, and smart contracts, Mashinsky said the third wave of money that “Celsius started” was yield. He said when JP Morgan Lends out customers’ money. They make billions a report it happily to their shareholders. Defi and yield farming puts that return from lent capital in the hands of the customers, not the bank, he said.

“They’re bragging about it to their shareholders, right,” he said. “But here, you can create yield and give it to the people who contributed the assets, not the people who manage them. And that’s where the revolution is.”

Unfortunately for consumers, he said the revolution is not about safety or new laws; it’s about who gets that benefit of invested capital. In a decentralized world, “we all benefit together,” he said, and the consumers get together and say, “No mas, you know, I’m mad as hell, and I’m not going to do this anymore.”

“That’s what I did. I just said I’m mad as hell, and 2 million people showed up and asked if there was room on the bus,” He said. “We’ve paid close to a billion dollars to almost 2 million people, charging institutions fees. They hate paying us monthly fees because no one else will give you these loans for hedging and market-making and all the other shenanigans they do to make money.”

According to the Wall Street Journal, Celsius hired restructuring and bankruptcy lawyers.

According to a new SEC staff bulletin, crypto custody holders and exchanges must prepare to hold enough cash on hand to pay out customer deposits in the case of bankruptcy or treat customers as creditors at the bottom of the payout list.

Jonah Crane, a partner at Klaros Group advisors, said that rule would apply only to public companies, but in general, signals that the fed might expect off-balance-sheet assets like loans and cryptocurrencies to receive liability backing from firms.

Celsius is not a public company, but its bitcoin mining branch quietly filed to go public, even during a bitcoin price downturn that placed mining into a net negative due to the cost of electricity.

Ahluwalia said crypto was not for the faint of heart; you need a disciplined approach to make it. He noted that retail lost millions, but the overall market didn’t cascade downward.

“The rule number one of crypto is to survive,” he said. “If you talk to crypto native, that’s the number one rule, and what that means is thinking about rug pulls or smart contracts that get hacked, where you can lose your funds.”