AUSTIN, Texas — Last year was marred by CeFi companies’ evidence on fraud, ultimately leading to waves of knock-on effects that continue to unfold.

Lawyers and investigators are still unpicking the latest meltdowns, but a picture is slowly emerging of how they happened in an industry that claims to improve transparency.

These failures “were a symptom of an underlying issue,” said Nathan Cha, Marketing Lead of dYdX, at Consensus Conference 2023 in Austin, Texas. Fundamentally, while the building blocks of DeFi create transparency that could protect users from last year’s CeFi fraud, the centralized entities that move within the DeFi world tend to avoid using them.

Last year, the result was a rash of complicated bankruptcies of which creditors continue to suffer the consequences.

Celsius: old school fraud brought to a new, DeFi landscape

Almost a year after Alex Mashinsky’s last public appearance at Fintech Nexus USA 2022, where he dubbed himself the “real Robin Hood,” the industry has a much better picture of the fateful steps that led to the company’s demise.

After filing for Chapter 11 bankruptcy in July 2022, Celsius was subjected to a court-ruled investigation following suspicion of fraudulent activity.

Related:

“Examiners are actually not that common in the bankruptcy courts,” said Shoba Pillay, the Examiner who handled Celsius’ investigation. “They come up when there are allegations of fraud and other transparency risks within the bankruptcy matter, which was a significant issue in Celsius matter.”

Pillay investigated the company, publishing her findings at the end of January this year. She explained that the majority of Celsius’ publicly communicated information turned out to be false.

“The devolution of the market impact itself Celsius significantly, and they did not publicly acknowledge that on a regular basis,” she said. “The fraud involved a lot of lying about the kind of investment risks.” She explained that across the board, claims of over-collateralization and money under management were flat-out lies.

Much of the company’s perceived value lay in the value of the native CEL token, named the “backbone” of the firm. Mashinsky often equated its value to the company’s value as a whole and used the token to inflate the company’s balance sheet positively.

However, the report found that the value of CEL had been repeatedly bloated by executives buying and selling tokens to increase value. Internally, employees perceived the token’s value as zero, defining it as “useless” and lacking liquidity.

In the published report, Pillay quoted internal communications between high-level executives. She wrote that “After a round of CEL purchases in September 2020, the same Celsius employees congratulated themselves on “our good work” resulting in “people thinking [the price of CEL] is going to the moon haha.”- a sinister approach from a company that claimed to be the “safest place for crypto.”

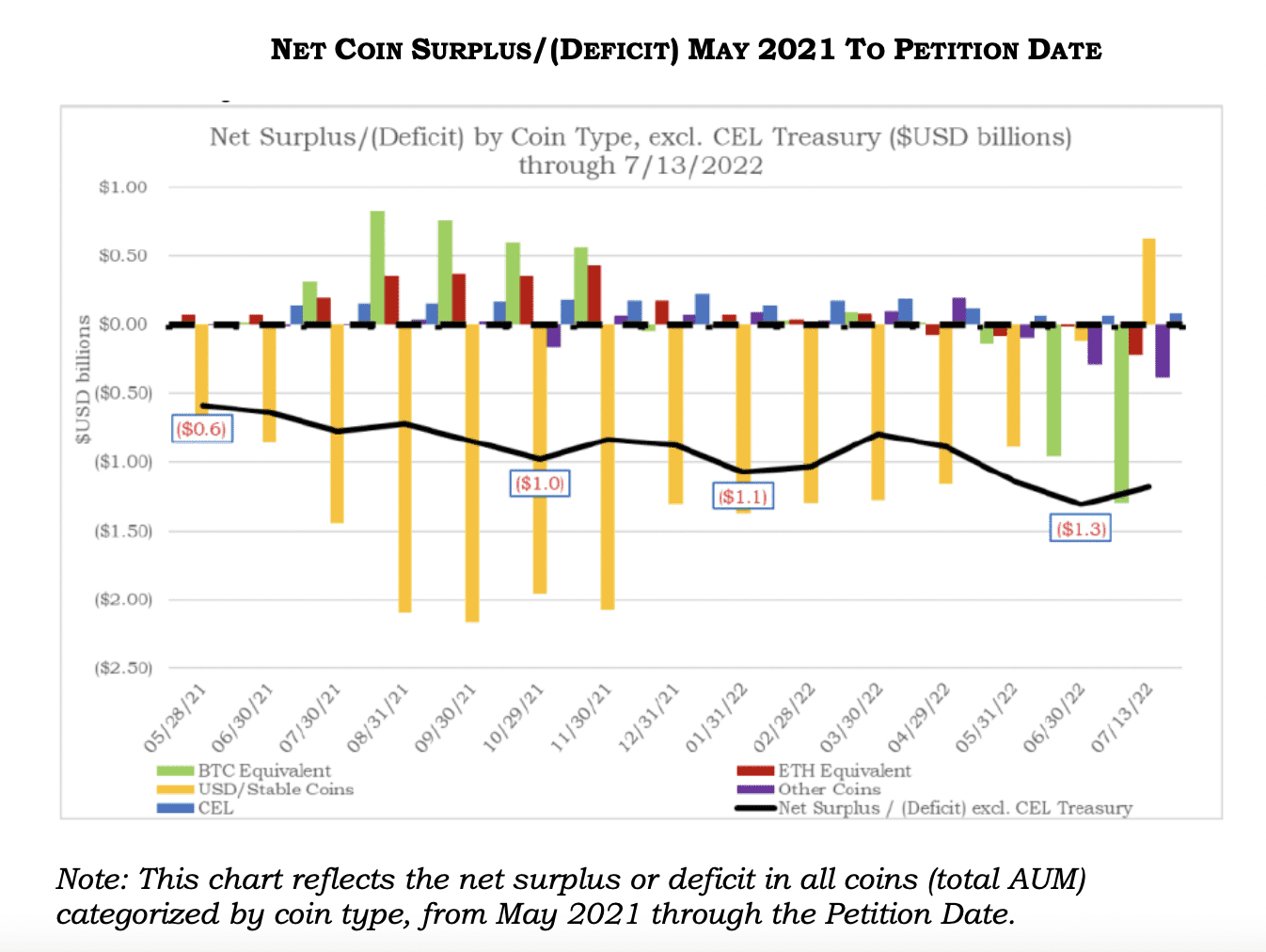

The company’s downfall came when the yield gained from deploying assets in its “Earn” scheme did not match its rate of buyback of the CEL token. As a result, it began using customer-deposited bitcoin and ether to fund its CEL purchases. Due to a lack of reporting systems to track customer assets, the firm could not track when its reserves fell short, leading to a $1.2 billion hole in reserves and their eventual failure.

Public blockchains could resolve transparency

In the wake of failures like Celsius, the question stands as to how it could come to pass. The DeFi community regularly touts the transparency of crypto technology as one of its significant advantages against TradFi.

However, the smoke and mirrors deployed by the disgraced crypto firms result from a lack of transparency, allowing them to make fraudulent claims without consequence. Protocols such as Proof of Reserves, sparked in the wake of FTX’s fall, while providing some level of transparency, only show half of the picture, instead acting to placate concerns rather than provide clear proof of companies’ solvency.

These actions have caused some to paint crypto and DeFi with a fraudulent brush, marking the industry as a “wild west” of scams.

“I think the core difference (between CeFi and DeFi) is self-custody. But more than that, from a technology perspective, it is using smart contracts and a blockchain to actually operate the business,” said Salman Banaei, Head of Policy at Uniswap.

“If you contrast like a centralized lending (CeFi) business, let’s say, Celsius. The money went to a wallet address, but then everything behind that was controlled, not using blockchain infrastructure effectively. It was a private ledger.”

“If you contrast that with DeFi lending, you can see the movement of funds at all times. And it’s always controlled using solidity and using smart contracts.”

Speakers at Consensus unanimously agreed that this had been a fundamental misunderstanding within the public regard of the crypto space.

Unclear regulation leads to higher levels of risk

The question remains whether many companies’ depositors will regain their assets. For those with assets locked in affected CeFi entities, the outlook is reportedly only going to worsen.

“Binance yesterday pulled out of a deal to buy Voyager, citing regulatory concerns,” said Deborah Kovsky-Apap, Partner at Troutman Pepper. “The SEC and U.S. regulations make it almost impossible for these companies to reorganize in a way that’s going to be regulatory compliant; it’s extraordinarily difficult. That creates tremendous risk.”

She explained that in most cases, companies file for bankruptcy with a gaping hole in their balance sheet, leaving customers’ hopes of recovering assets hanging on the companies’ eventual reorganization and new value creation by the new entity.

The heightened difficulty in reorganizing the firms could mean customers are left hanging, only regaining a minimal amount of their claim (if anything).

“Can companies be regulatorily compliant in the United States in this environment?” she continued. “I think that’s a huge question mark and a huge risk, both for customers and creditors in the bankruptcies and for claims buyers.”

Perhaps the familiar refrain of “not your keys, not your coins” is the only policy to guarantee survival.