This fall’s looming student debt crisis will bring the worst environment we’ve seen in decades. Fortunately, Candidly founder and CEO Laurel Taylor said there’s a way out for many. However, few people are aware of it.

Candidly, formerly known as FutureFuel.io, is an AI-powered platform for student debt and savings optimization. Its origins lie with Taylor’s experience with student debt, which saw her and her mother accrue almost $200,000 in education bills.

Taylor’s not alone. Roughly 80 million Americans find themselves at some point in the education funding cycle. They could be paying off their education or helping their children with theirs, with some saddled with both.

How the pandemic has made the student debt crisis worse

Taylor said that the United States is seeing its most significant upheaval in student debt since at least 2008. This is because of the student loan repayment moratorium that expires on Aug. 31. She estimates that 60% of student loan borrowers received that 30-month reprieve.

Those borrowers are now used to repurposing an average of $393 per month towards groceries, gasoline or paying down other debt. Nearly 90% say they’ll struggle to transition back to student debt repayment once that resumes. It’s the ultimate buy now, pay later, Taylor said

Collectively, 43 million Americans hold $1.75 trillion in student debt. That’s one out of eight people. According to NerdWallet, the average American household with student debt owes $57,520. Currently, 7.6 million of those borrowers are either in school or the grace period; 460,000 are in repayment, 3.05 million are in deferment, and 26.78 million are in forbearance.

Taylor said one of the most frustrating things about this crisis is that it is unnecessary, because there are options to reduce the monthly payments or forgive the loan entirely.

Candidly provides an escape route

“The great news is we have a way of helping users enroll in federal savings programs, even if you don’t work for a nonprofit,” Taylor said. “Users can enroll in income-driven repayment programs, which will lower the monthly payment commensurate with their discretionary income.”

Taylor said those options are poorly promoted and cumbersome to administer and register for. Only 6.7% of people eligible for the Public Service Loan Forgiveness (PSLF) program have applied for help. The rest are unaware of the possibility or find it too daunting. Of the 6.7% who have applied, only 2.1% saw approval, meaning one-seventh of one percent of eligible people are receiving help.

Candidly has wholly digitized the process by providing best-in-class, out-of-category technology to student debt financing. They meet users where they are by offering the tool as a workplace benefit and banking reward, saving folks an average of $300 per month. The latest company to partner with Candidly is Vanguard.

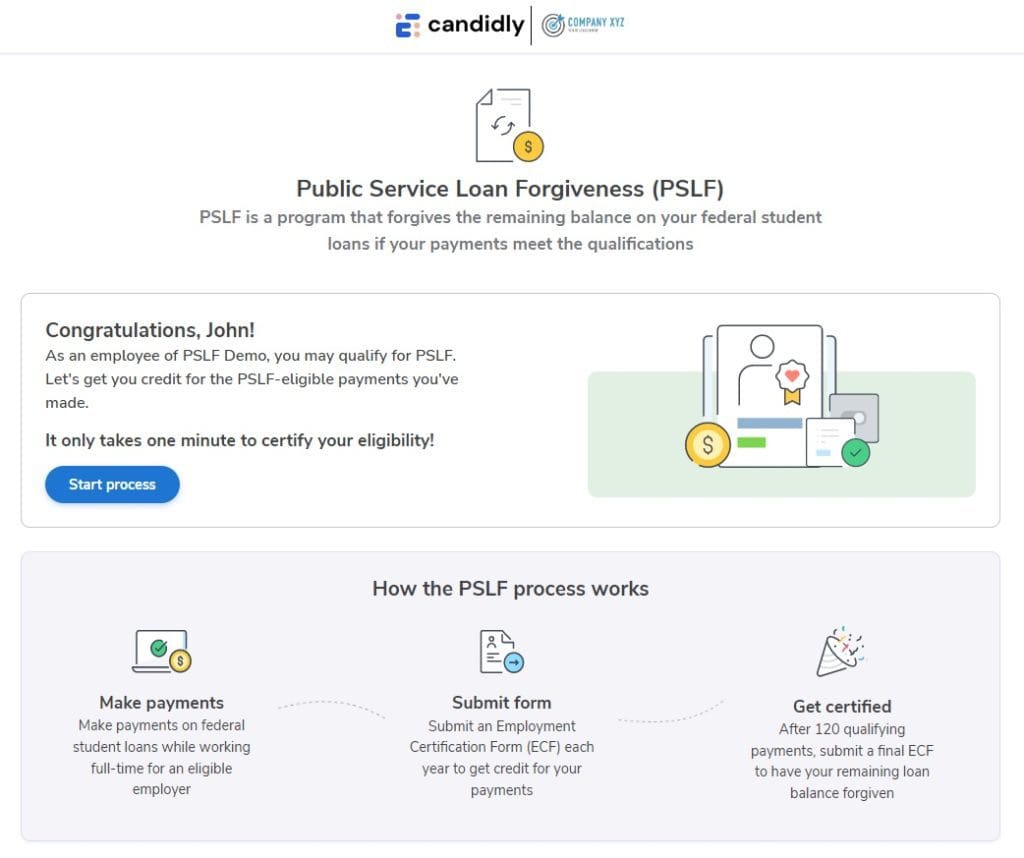

New PSLF tool simplifies administration, provides value

On June 29, Candidly released its PSLF tool that automates the PSLF application process. Borrowers connect their loans to that platform, which checks eligibility and returns a response in an average of 90 seconds. Through proprietary algorithms, Candidly’s system provides guidance and immediate actions that help borrowers maximize their loan forgiveness.

Taylor said the early results are encouraging, as 65% of PSLF applicants are eligible and have never applied for forgiveness. Eligible borrowers are poised to save an average of $67,000.

Candidly also simplifies the process for employers, making it a feasible benefit for them to offer employees. Taylor said it takes administrators an average of 79 seconds to certify an application. Candidly handles the rest, including sending it to the loan servicer and Department of Education for review.

Taylor said many people work for a company for years and didn’t know they were eligible for debt forgiveness.

“We thought we’d see many users who are already quite sophisticated coming into this,” Taylor said. “We’ve found the opposite: this is a net discovery.”

How it works

When borrowers sign on to the platform, they are asked about their student loan payments, income and marital status. Those responses are run through algorithms, and three recommendations from a set of three million unique combinations are presented.

“PSLF is a program that forgives the remaining balance on your federal student loans if your payments meet the qualifications,” Taylor said. “Make payments on your student loans, and submit your employment certification form each year to get credits for your payments. After 120 qualifying payments, submit a final employer certification form to have your remaining plan balance forgiven.”

Taylor said the Department of Education has expanded PSLF eligibility until October 31. Those benefits include receiving credit for past payments that would not have otherwise qualified, such as late or partial payments. Any additional policy changes are integrated into the system in real-time.

PSLF as an employee acquisition and retention tool

Employers log into the system and see how many employees have submitted certification forms. The algorithm ensures eligibility, saving the employee processing time. Coaching assistance will soon become available.

Making it easy for employers is the key to providing a benefit that can help recruit and retain employees.

“Employers are very concerned about their employees’ financial health and wellness,” Taylor said. “They want a healthy employee population that can show up and perform at their best. The data around financial stress and distress and performance at work is really clear.

“Employers are committed to financial inclusivity and offering a benefit stack that addresses the full spectrum of financial health and wellness within the workplace. Employers are committed to financial inclusivity and to diversity, equity and inclusion in the workplace. Two-thirds of student debt is held by women, and persons of color.”