The ethereum merge, although a slight anticlimax in terms of speculative value, has brought the energy consumption and carbon footprint of major blockchains well into the spotlight.

Bitcoin has been particularly under fire.

A blockchain long known for its anti-ecological impact, many are inclined to sweep its issues under the rug. The word in the crypto community is that bitcoin miners are improving things and that renewable energy will make up for consumption. According to reports, the amount of energy used by bitcoin is now 57% from renewable sources, and entities such as The Crypto Climate Accord are working on increasing this number until they reach net zero.

The piles of electronic waste (e-waste) generated by miners continue to grow at a supercharged rate.

“Bitcoin mining is essentially waste by design,” said de Alex de Vries, Founder of the Digiconomist, in an NBC News interview last year.

“It’s a system where participants are forced to waste resources to provide some level of security on the network. The more value bitcoin has, the more money it’s worth, the more we spend on resources.”

A network designed to work from individual home computers has morphed into a billion-dollar beast. Mining companies, operating tens of thousands of miners, have sprung up worldwide, each requiring vast amounts of expensive, powerful hardware and a constant high-level supply of electricity. Barriers to entry have been made higher by these companies, pushing out individuals looking to mine from home.

As the value of bitcoin rises, so does the attractiveness of mining it, locking the industry into a perpetual upward spiral of waste, consumption, and dubious decentralization.

Apples to oranges

An issue in part could be the lack of comparison of bitcoin to anything similar. The blockchain is the largest of its kind and since the merge, it dwarfs other PoW blockchains even more.

On approaching even the subject of bitcoin energy consumption, one is met with an insufficient comparison scale.

The Cambridge Bitcoin Electricity Consumption Index (CBECI) comparison website states, “There is nothing quite like bitcoin that can be readily used for an apples-to-apples comparison.”

“Bitcoin is many things to many people: some consider it a new store of value in the form of a synthetic, counterparty-free commodity; others prize the underlying value transfer system that enables both payment and settlement functions in a permissionless and censorship-resistant fashion, and still others are primarily drawn to the incorruptible notary function enabled by its tamper-resistant public ledger.”

“As a result, direct comparisons to other activities that appear similar on the surface can only provide a partial – and thus necessarily incomplete – picture.”

This inability to sufficiently compare its energy consumption and carbon footprint leaves the issue open to interpretation.

Yves Longchamp, Head of Research at SEBA Bank highlighted that bitcoin’s energy consumption contributes to the security of the blockchain. In order to exist as it is, he feels the energy consumption may be necessary, especially from the point of view of bitcoin supporters.

“Bitcoin is by far the most secure crypto in the world. It has never been hacked, and the cost of hacking is proportional to the energy used.”

“That’s the USP of bitcoin – something which is outside the financial system, something which is peer-to-peer censorship-resistant and kind of unattackable….It has a cost, but it has also advantages and I think we need to take that into account. Then it’s obviously up to you to decide if these advantages outweigh the energy consumption. Or you can say no, I think it’s a waste of energy, and you can stick to PoS coins.” He explained that only two of the top 20 coins use a PoW system.

For others, proportionally the carbon footprint of bitcoin is negligible. The consumption issues call for additional iterations of PoW, rather than complete “demonization.”

“You have to put it in perspective,” said Daniel Keller, Founder of Flux. “What is the footprint of the financial markets today? The town I live in has physical banks everywhere on every single corner, which would contribute massively.”

“Crypto miners are aware of the energy costs and the environmental impact, and they look for clean, cheap, renewable energy. I can’t say the same for the legacy financial system.”

Despite this, stunning figures showing bitcoin consumption outweighing that of whole countries leave the issue like an open wound on the face of bitcoin, begging to be sutured.

But the issue goes beyond renewable energy

“Cambridge just released a new report, a couple of weeks, saying 60% of the energy for the network is coming from fossil fuels. And that’s probably still on the optimistic side,” said de Vries to Fintech Nexus.

“We see that even in countries like Sweden, where we have some mining activity and a large share of renewables on the grid, saying they don’t want to use that for bitcoin mining. If they put it into bitcoin mining, that means that they will have to put fossil fuels in their more essential services.”

He explained that even in an ideal world, where all energy came from renewable sources, mining would still bring a number of issues that could damage the environment.

“There’s one bitcoin mine in Texas being built, that will take 1.4 million gallons of water, just for the cooling system,” he continued.

“The mines also causes noise pollution, and of course, the local wildlife will be affected as well. Those are problems that any amount of renewable energy cannot address.”

The issue of e-waste

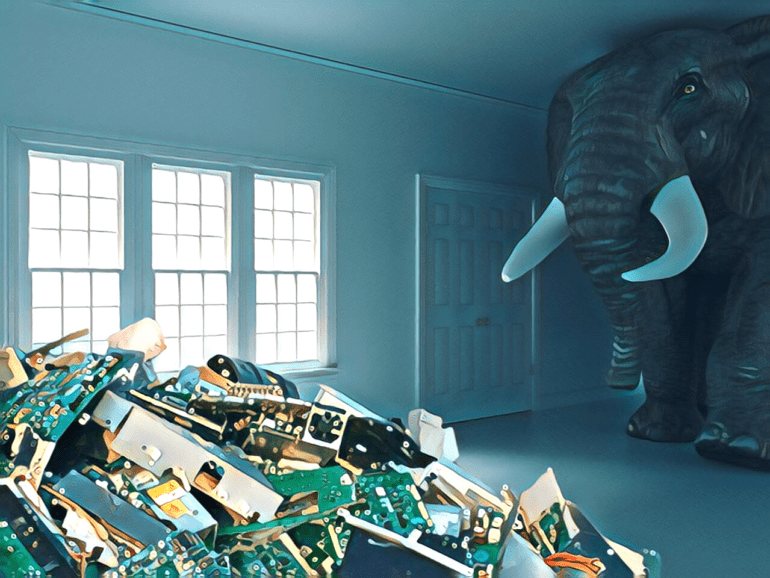

With debate raging around the validity of concerns on bitcoin’s energy consumption, its rising e-waste problem sits like the elephant in the room.

The discarded appliances and hardware that create e-waste are made up of metals and plastics, many of which are not biodegradable and harmful to humans. The effects of exposure can cause catastrophic health problems.

Increasingly e-waste is not made up of obsolete hardware, and this is particularly true for that used by miners.

In a study conducted by de Vries in 2019, it was explained that “the chance of mining a new block depends on the proportional share of computational power in the network. Any increase in the total computational power of the network will marginally dilute the share of every individual device and thus reduce individual earning capacity.”

According to de Vries, the only way a miner can create an advantage is by being more efficient. This makes it a necessity for processors which work at their optimum level and a decreased timeframe before they are rendered e-waste.

“If you drill it down, and you look at the average amount of e-waste generated per bitcoin transaction, you’re still talking about around 400 grammes of electronic waste,” he said. “That is the equivalent of more than two iPhones thrown away for every single transaction.”

According to Statista, last year daily transactions of bitcoin averaged at around 250,000.

“Also, the carbon footprint relating to transaction can easily exceed 800 kilogrammes of carbon dioxide. That is more than the carbon footprint of a passenger on a flight from London to New York.”

Recycling is available for e-waste but is seldom used at a level that matches the amount of e-waste produced. In China, previously the top hub for mining, it is estimated that only 16% of all e-waste was formally collected.

“Only 50% of global e-waste is being recycled,” he continued. “All the rest ends up in informal circulation where it just ends up laying around for some time. Toxic materials in the hardware leach into the soil reaching into the groundwater, until those machines are ultimately taken apart for parts and taken to the incinerator when the toxic waste toxic materials also end up in the air. Of course, it produces carbon emissions as well.”

He explained that a lot of bitcoin e-waste is made of aluminum, which could be recycled easily. However, due to a lack of recycling programs, a vast majority ends up in informal circulation.

Is there any way to save bitcoin’s failings?

It seems the future is bleak for the sustainability of bitcoin.

Mass mining has pushed the blockchain towards increased consumption of resources, with little hope of diminishing.

“As long as bitcoin continues to run on proof of work miners, the situation is unlikely to improve,” said de Vries. “It generates a massive incentive to just keep on creating newer, more powerful equipment, and throwing away older equipment when it becomes less efficient and therefore unprofitable to run.”

Multiple sources agreed that bitcoin is unlikely to change its consensus system, leaving only the creation of recycling systems and other sustainability-focused initiatives to improve its sustainability.

Other systems such as Proof of Useful Work could offer an alternative however, at potential cost to decentralisation.

“One big problem with it is the definition of “useful work.” The whole idea of blockchain is that it’s supposed to be decentralised, there is not supposed to be an authority. You can’t do Proof of Useful Work without a central authority defining what is useful.”

“Unfortunately, a bitcoin is the word actually has to be useless. Otherwise, it wouldn’t be very decentralized.”

A sobering perspective for a world in the midst of an energy crisis and headed for irrevocable climate destruction.