Due to COVID-19 restrictions, the SME sector has faced numerous challenges over the past few years.

With inflation rates at an all-time high, alternative lenders have become critical to survival.

“It’s at a pinch point today. You have employment costs going up and energy costs going up. For any business, it’s going to be difficult going forward,” said Ravi Anand, Managing director of alternative lending firm, ThinCats.

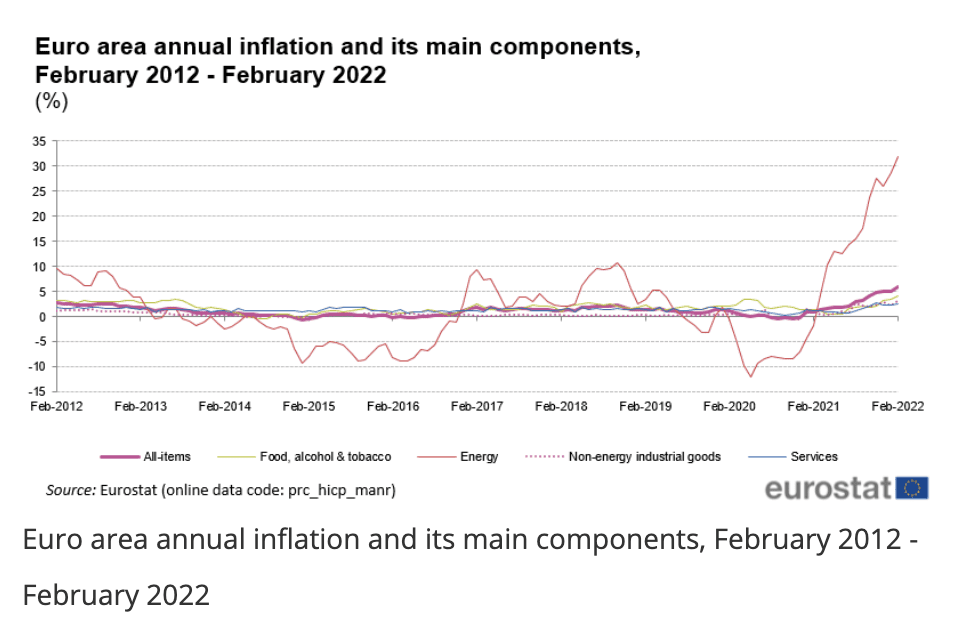

According to Statista, after a significant dip in inflation in 2020 to 0.68%, it skyrocketed to 2.43% in 2021 within the European Union. This level has remained high, with Eurostat reporting a continued increase to 5.9% in February 2022.

The main component of this has been energy which reached 32% inflation in February.

Increased sanctions due to the Russian invasion of Ukraine have resulted in a restriction of access to oil and elevated prices as it continues.

This, along with predicted inflation following recovery from the COVID-19 pandemic, contributes to the surge in inflation, which will continue to affect the SME sector.

ThinCats receives further funding for pandemic recovery

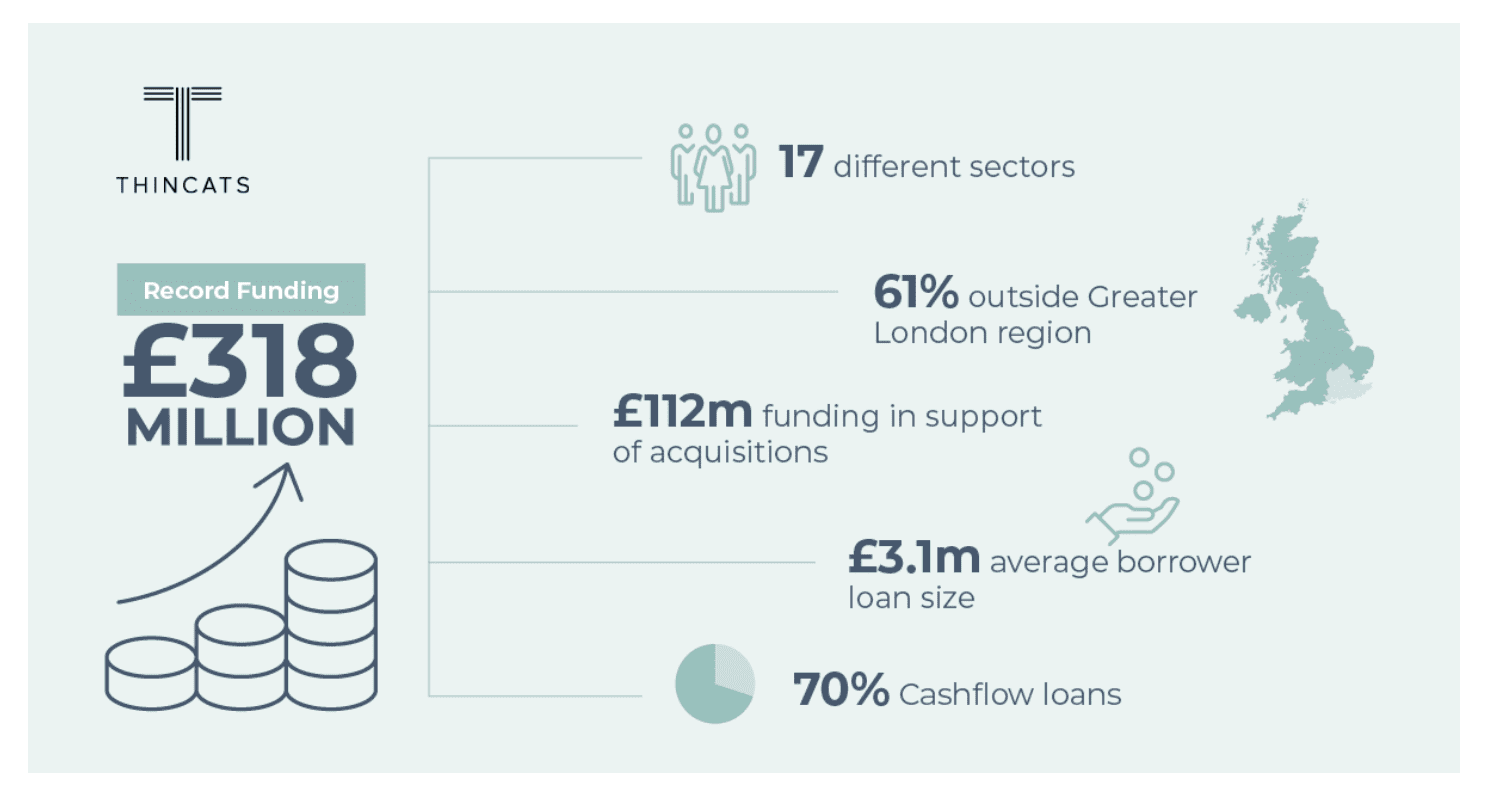

ThinCats, focused primarily on providing alternative funding for mid-sized SMEs, has been a significant help to their clients during the ongoing recovery from the COVID-19 pandemic. Reported to have lent a record £318 million during 2021, they recently announced securing a further £100 million from their ongoing investment partners, Insight Investments.

“We’ve been with Insight since 2018,” said Anand. “Their portfolio has been through COVID and out the other side, and because it has performed well, they have decided to extend their funding line.”

ThinCats is a balance sheet lender, putting their capital at risk while receiving funding from senior lenders. They work by syndicating loans, receiving parts of a loan from different senior lenders. Diversity within portfolios is improved, and their own balance sheet risk primarily focuses on large cash flow loans unsecured by assets, is managed.

“It may be certain challenger banks may have certain straitjackets when it comes to credit, policy and sector constraints…the higher risk weighting discourages them from unsecured lending,” explained Anand.

“As you go up in loan size, the skill set required to understand the business goes up. We have tried to create people, processes, and systems to address that cohort (of non-asset-based businesses) and fill the gap the banks have left behind for 20 years plus.” he continued.

Mid-sized SMEs see growth

Between April and December 2020, SMEs increased their capital borrowing to survive the heavy restrictions of the COVID-19 pandemic.

The borrowing was varied according to business size. Thirty-five percent of small businesses receive funding, amounting to £45 billion, mainly from the government-backed Bounce Back Loan Scheme. Only 18% of medium-sized companies did the same.

According to their books, ThinCats have seen a 60% increase in net cash of mid-sized SMEs, indicating that the borrowing that was incurred resulted in a growth of businesses.

They predict the mid-sized sector will continue to thrive going forward, with insolvency returning to pre-pandemic levels and not much higher over the next few years.

The same is not predicted for small SMEs. The higher borrowing rates have resulted in only a marginal increase in net cash of 5%, painting a picture of survival rather than recovery and growth.

SME lending

Although ThinCats is focused on the mid-market sector, there have been many other alternative lenders supporting small and micro-businesses over the past few years.

Primarily data-driven, alternative lenders for SMEs have broad portfolios of thousands of small businesses. The portfolios of lenders such as ThinCats, on the other hand, consist of a few hundred.

Funding Circle is one of the alternative lenders focused on the small businesses of the SME sector. Originally a peer-to-peer lending platform, the company offers business loans on application. Loan decisions are made quickly with low interest rates by connecting companies with investors.

Although initially working with both Institutional and retail investors, in April 2020, the platform closed itself to the retail investor sector. This accounts for 5% of total loans under management by the platform.

Globally the firm has facilitated borrowing for 122,000 businesses, amounting to a value of £13.5 billion, and was accredited by the UK government to loan up to £350,000 through the Covid Recovery Loan Scheme.

By providing and managing a range of loans, from sole traders, unsecured business loans to small business loans, they offer clients ease of use. Applications take 10 minutes to complete, and funding in under 24 hours after decisioning.

They offered the facilitation of various support during Covid, including tax deferrals, coronavirus future funds, and various grants and business rates.

Elevated levels of defaulting loans predicted

Although functional and maintaining a positive rate of return, they too predict elevated levels of defaulting loans and reduced return rates in the coming years.

In the retail outcomes statement published in 2021, they stated, “A range of measures have been introduced to support small businesses through the impact of Covid-19, including payment plans offered by Funding Circle and government stimulus measures.”

“As defaults lower the return earned by investors, the actual annualized return is higher than it would be if this support were not in place. As economic conditions return to normal through 2021, we expect this to be reflected in an increase in loan defaults and a reduction in the actual annualized return.”

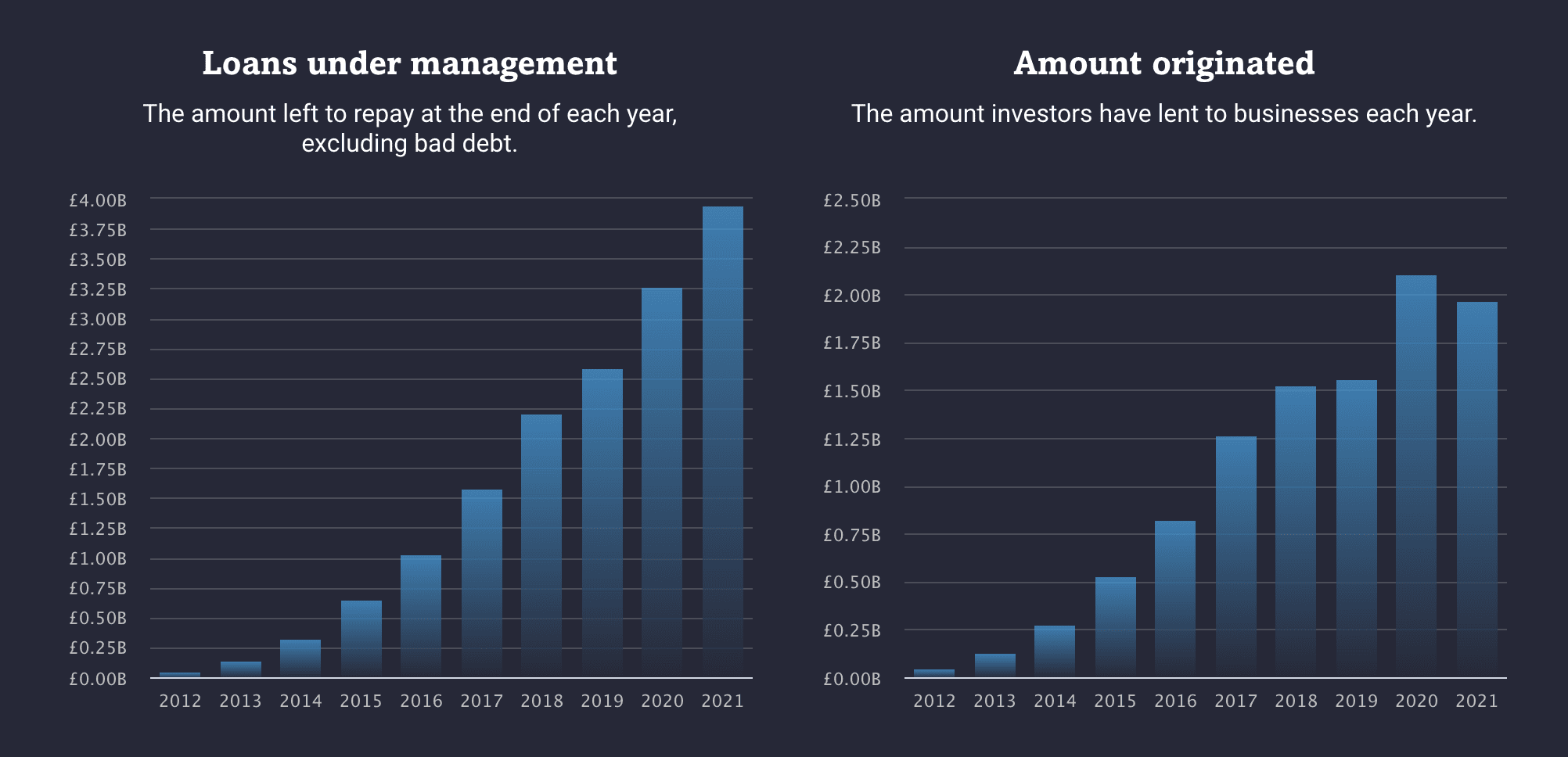

According to their statistics, the amount left to repay at the end of the year, excluding bad debt, has continued to increase. Lending declined marginally between 2020 and 2021 after shooting up by half a billion globally between 2019 and 2020.

Alternative funding essential going forward

“There will be a lot of issues surrounding supply chain employment and general inflation. I think banks will become a lot more cautious… this plays right into the hands of alternative lenders,” said Anand.

Although midsized SMEs have seen increased net cash, indicating a higher resilience to the challenging economic climate, small SMEs did not see the same growth. Higher borrowing levels during the height of pandemic restrictions may result in higher levels of defaulting loans due to inflation and higher costs incurred.

Reduced lending of banks, given the higher risk incurred, creates a market that is ripe for alternative lenders.

“(Alternative lenders) have been lenders where banks have struggled to take care of their customers… As we come out (of the pandemic), we see bank appetite being more constrained, driven by many losses due to the Bounce Back Loan Scheme (BBLS). Generally, banks tend to be on the more cautious end of lending,” said Anand.

“What we can do is look through that and look at good businesses in weak sectors and avoid bad businesses in good sectors. The sector dynamics matter, but it doesn’t mean that every business is the same. Within that, we can fund growth.”