Argentina’s fintech unicorn Ualá will invest $150 million over the next 18 months to boost its digital banking endeavors in the region, Pierpaolo Barbieri, its CEO and founder, said this week during the company’s fifth anniversary.

Founded in 2017 in Buenos Aires, the company started targeting the underbanked in the region with various digital banking products. Five years later, the fintech has expanded sizeably. It has grown a presence in three countries, took over half a billion in funding, bought one bank in Argentina, and is acquiring another in Mexico.

“Our next five years will be much more ambitious,” the CEO said during an event. “We will invest 150 million dollars in our markets with the conviction that it is possible to provide access to high-quality financial systems through technology.”

The company will invest in the short term to grow its business outside Argentina, mainly in Mexico and Colombia, where it recently launched. Altogether, Ualá reports 5 million customers in Latin America and has set the ambitious goal of growing that number sixfold to 30 million by 2027.

Dream just starting

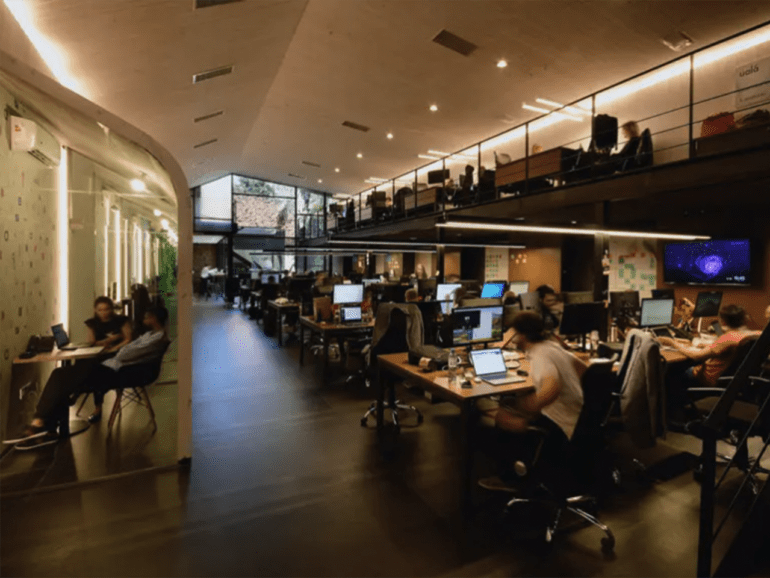

“Ualá was born to revolutionize regional finances, making them more modern, transparent, and inclusive. Creating a regional company that employs more than 1,500 people is a dream — and one that is just starting,” the CEO said in its fifth-anniversary gathering.

To be sure, the company is leveraging on the big pockets backing its business. Big names such as Chinese Tencent or Japanese Softbank are among its investors, allowing Ualá to stand out in an ecosystem where many fintech lenders have cut down spending and moderated expansion strategies.

Fintech multiples have crumbled across the board, and capita is not as ubiquitous as it was one year ago. But the company, valued at $2.5 billion in its last funding round, is confident it is sufficiently capitalized to consolidate its footprint in Latin America.

“In a market context where others are cutting investment, we are expanding because we already have the capital,” the CEO said in a recent interview with Reuters.

Latest growth stake

Ualá was already present in Mexico since 2020— where it is in the process of buying a bank license from ABC Capital— and launched in Colombia earlier this year. In January, Barbieri announced an initial investment of $80 million to grow a market share in South America’s third-largest economy. Other fintech competitors like Nubank have also laid eyes on the Colombian market and initiated operations.

Related:

On its home turf, Ualá recently announced the acquisition of the Argentine Buy Now, Pay Later company, Ceibo Creditos, and an e-commerce site, Empretienda. In a statement, the company also said it had completed a 100% acquisition of Wilobank, the first digital bank in the country. With the purchase, the fintech obtained a banking license which allowed it to boost its loan business.

“According to the Bank’s Global Findex report World, only 31% of Argentines reported having requested a loan from a financial entity throughout 2021,” Joaquin Dominguez, Credit Director at Ualá, told Fintech Nexus. “We are constantly looking for new tools to solve the region’s economic needs.”