Yesterday, Feb. 1, 2023, U.S. Federal Reserve Chair Jerome Powell announced yet another rate hike, making it the eighth increase since March 2022.

While the interest rate was only marginally raised, a quarter of a percentage point, Powell expects to implement further raises shortly.

Although rate increases are seldom a good thing, there is a sense of relief in the news. Predictions for the hike had before sat at a much higher mark, and the resulting 0.25% is the smallest announced in the past year.

During the press conference, Powell stated “the disinflationary process” was underway.

Hope on the horizon?

Startups have been significantly affected by ongoing hikes. The lower percentage point is welcome news but follows a long year of blows that have affected valuations, the ability to gain investment, and general survival.

“The rate hikes are having a catastrophic impact on the tech markets, which are valued on long-dated future cash flows as discount rates increase,” said Don Muir, Co-Founder and CEO of Arc Technologies.

“I think we’re in for some challenging times for startups, particularly those with a low runway. But if they can weather the storm for the next 12 months, I think there’s a light at the end of the tunnel.”

“In today’s macro environment, earning yield on idle cash can be a key advantage for startups looking to extend their runway and avoid layoffs.”

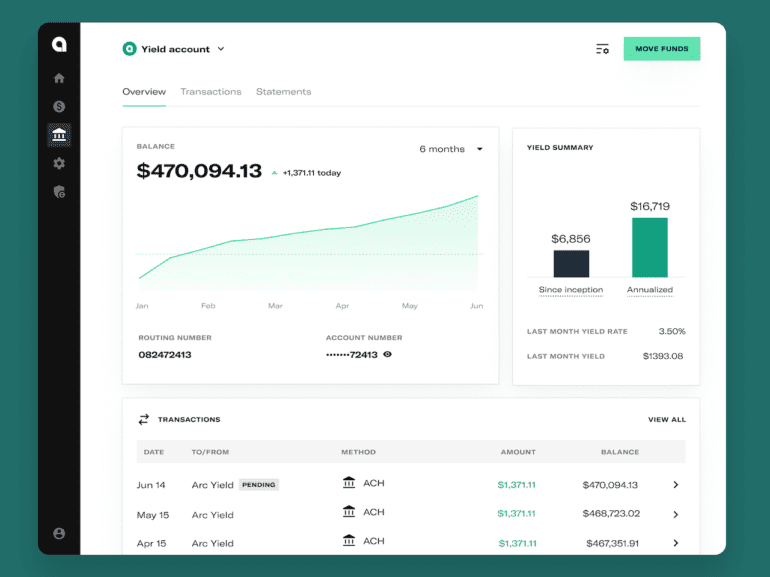

To this end, Arc has announced its Yield’s launch today.

High yield to accelerate access to capital

Yield is a product extension of the Arc Treasury, offering startup banking tools, including free money movement, unlimited cards, scheduled payments, and customizable spending controls.

RELATED: Arc Technologies launches Advance Plus

The company has raised rates to 4.00% APY allowing users to gain more on idle cash while reducing some limitations of traditional high-yield accounts.

“We eliminated balance tiers and caps tied to APY, so startups earn 4.00% on their entire yield deposit balance. We eliminated the need for sweeps to earn yield, so startups’ funds remain FDIC-insured and can be withdrawn by founders at a moment’s notice,” said Muir.

Adding to existing tools created to support startups, particularly during this inflationary period, Arc clients can now unlock non-dilutive funding, securely store funds, tap into Arc’s investor and partner network, and access a host of advisory services.

Although admitting that the inflationary environment has been catastrophic for start-ups, Muir remains hopeful about the outlook for the year ahead.

“I’ve met with thousands of software founders over the last two years, and the level of resiliency, the scrappiness, the Hustle that I’ve seen in good times and in bad gives me the conviction that the market will come back with a vengeance by the second half of next year,” he said.