The LendIt Fintech News team has long featured reviews detailing the process for borrowers applying for loans through companies like LendingClub and Prosper. The reality is that the landscape for online loans today is much larger than these two fintech firms which dominated the industry a decade ago.

There are dozens of companies competing in the personal loan space, from the big banks who have either launched a new unsecured online loan or intend to do so, to the many successful fintechs we see in the ecosystem today. While receiving a loan online isn’t novel in 2019, every consumer lender today offers a slightly different user experience and most importantly, varying interest rates. Since we like to keep up to date with the current landscape we’re always excited when borrowers are willing to share the details of applying for a loan online. In this post we review the process of someone looking to consolidate approximately $10,000 of credit card debt.

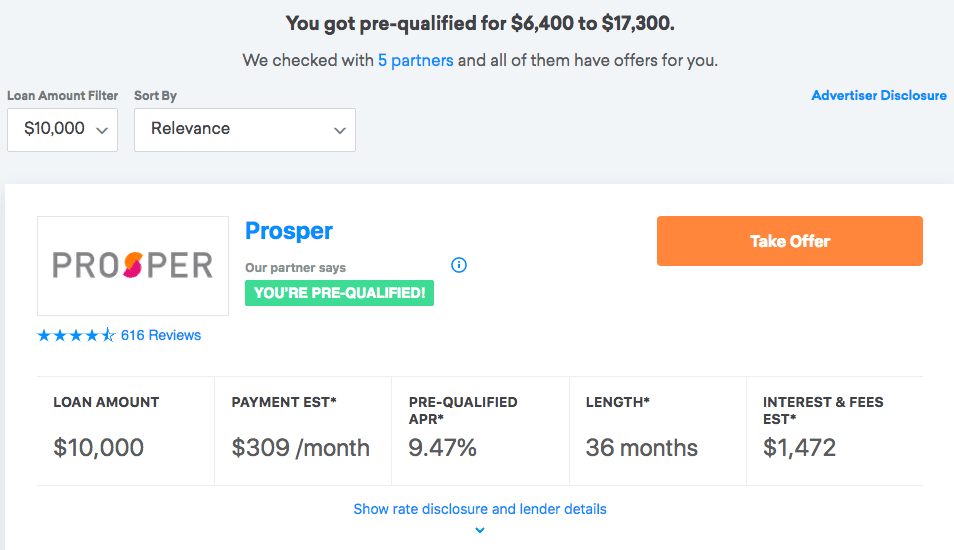

One thing many borrowers don’t realize is that you don’t necessarily have to go to every single loan provider’s website to get an offer of credit. Sites like Credit Karma and LendingTree work with many lenders which can save time in finding the cheapest cost of credit. Below is a screenshot from this particular borrower’s Credit Karma account showing that they are pre-qualified for a loan through Prosper. This was just one of many of the options displayed to this borrower.

You can see in the table below that this borrower was able to receive a variety of offers with interest rates ranging from 9.47% to 13.99% and terms between 2 and 3 years. The most important field here in this person’s situation is the all-in cost of the loan, which includes interest and fees. While Prosper offered the lowest interest rate for this borrower, Lightstream was actually the cheaper loan due to the fact that they do not charge origination fees. Note that Prosper’s offer was a three year loan while Lightstream offered a two year loan term. Since this borrower planned to payoff this loan aggressively within the next 4-6 months the Lightstream loan was the best option. Other borrowers may value the flexibility of having a longer term loan which Prosper and others offered. Note that the FICO score of this borrower was around 720.

| Lender | Loan Amt | Pre-qualified APR | Length (Months) | Payment | Interest & Fees | Phone Calls? |

| SoFi | $10,000.00 | 10.60% | 24 | $464.22 | $1,141.28 | No |

| Lightstream | $10,000.00 | 10.09% | 24 | $461.86 | $1,084.64 | Yes |

| Prosper | $10,000.00 | 9.47% | 36 | $309.00 | $1,472.00 | No |

| LendingClub | $10,000.00 | 10.35% | 36 | $311.00 | $1,608.00 | Yes |

| LendingClub | $11,000.00 | 12.35% | 36 | $348.83 | $1,557.88 | |

| Upstart | $10,000.00 | 12.59% | 36 | $318.00 | $1,954.00 | No |

| Best Egg | $10,000.00 | 13.49% | 36 | $326.00 | $1,732.00 | No |

| Marcus | $10,000.00 | 13.99% | 36 | $342.00 | $2,302.00 | No |

We also wanted to get an unbiased perspective on the actual user experience. Here is what this borrower had to say about each company’s process:

- SoFi: User experience was friendly. Issues with uploading ID’s though. Had to try several times.

- Lightstream: This is the loan I chose. The application was quick and the rates came within a day. The phone call I received was only to see if I required anything further or wanted more information.

- Prosper: These rates were supplied by Credit Karma. Prosper wanted me to go through the full application and submission of my ID’s before locking in a rate.

- LendingClub: I received several phone calls to verify my identity and needs which I thought was annoying and redundant. Plus they called me and wanted me to verify all of my SSN/etc. which felt more like a phishing call and less of a customer service call.

- Upstart: Wasn’t a fan of the 3 year term, so I didn’t pursue.

- BestEgg/Marcus: Didn’t consider due to the rates provided on Credit Karma.

Conclusion

There has been a dramatic power shift in consumers’ favor over the last few years when it comes to personal loans. Never before has the consumer had so much information about the loan options available to them in a matter of minutes. What’s interesting is that the list above of companies in unsecured lending is not comprehensive, there are many big banks and other fintechs who offer similar products. One of the things we’re keeping a close eye on is how fintech lenders and banks go beyond offering just an unsecured loan. When the borrower has transparency into many options, it becomes more important to differentiate with user experience and serving customers throughout their financial lives.