Building on their suite of financial products, today, April 17, 2023, Apple launched a high-yield savings account in partnership with Goldman Sachs, with no minimum balance or monthly fees.

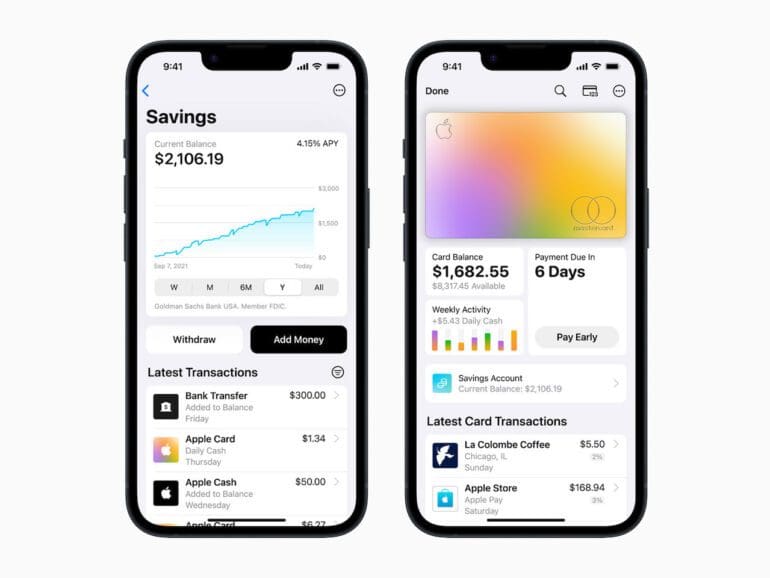

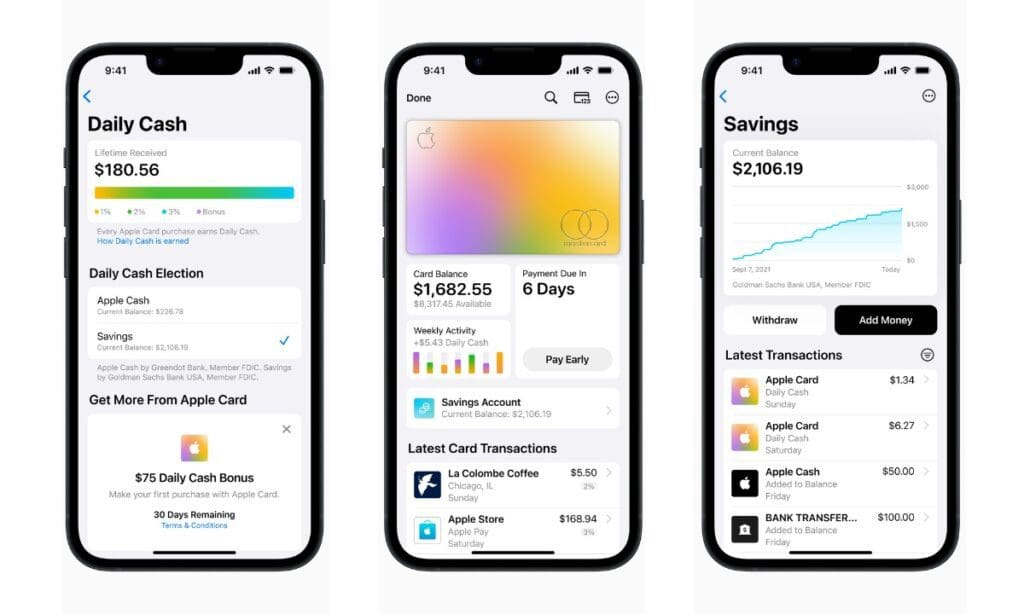

Users of the Apple Card can set up a savings account directly through the Wallet, taking advantage of the 4.15% APY, which is more than 10 times the national average for yield rates, as per the FDIC’s recent census.

The Apple Wallet will now include a savings dashboard, allowing users to track their account balance and interest. The company’s cashback solution, Daily Cash, will automatically add to the saved balance, and users can deposit additional funds through linked bank accounts or their Apple Cash balance.

The firm’s representatives say the savings account adds to their goal to support customers in leading “healthier financial lives.”

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Wallet.

“Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Twitter is, however, filled with skeptics, voicing concerns about anti-competitivity and the growing threat to regional banks.

Others are puzzled by Goldman Sachs’ backing of the product, questioning the finance giant’s fintech arm, Marcus, high-yield savings account’s lower rate, and its position as a potential competitor.

Although the announcement is sparking concern, many remain unphased about its effect on the wider ecosystem. Kristina Leach, Director of Global FSI Insights at Quantum Metric, explained that she felt it was unlikely the product would have a significant impact on the wider banking system.

“There are many other high-yield savings account options available from banks that offer higher interest rates and do not require consumers to have to have an iPhone and Apple card, as Apple’s new account does,” she said. “However, it’s important for the banking industry to pay close attention to how brands like Apple and Amazon grow their financial services offerings.”

She explained that the brands’ high levels of customer loyalty could make them formidable competitors within the finance sector. As big brands gain more experience in the industry, customers may shift from using banks as their main financial services provider.

“Banks must focus on improving their digital customer experiences to remain competitive, streamlining clunky onboarding processes and delivering friction-free interactions like those offered by Apple and Amazon,” she continued. “If they fail to do so, consumers may seek out providers that can deliver these types of experiences.”

RELATED: What’s Going Wrong at Goldman Sachs’ Marcus Consumer Bank Unit