Save now, buy later capability as an embedded e-commerce service is Accrue Savings’ response to the waves of credit forced on consumers for decades. It’s so unique that it earned a spot on Time Magazine’s 2022’s 100 Best Inventions list.

For CEO Michael Hershfield, the cause is personal. Raised in Vancouver, BC, Hershfield was taught the importance of living within his means. That conflicts with today’s focus on consumerism which has driven the creation of credit products for decades. BNPL, store-branded credit cards, installment payments, and more have been developed to encourage consumers to buy now and deal with the consequences down the road.

Accrue Savings tapping into huge demand, from consumers AND merchants

Hershfield considers that focus on credit one-sided and a missed opportunity, especially in today’s climate. You wouldn’t know it, but 60% or more of American consumers are saving for some major purchase. Why not meet their needs using some of the strategies employed on the credit side?

“It’s an important time to offer something like this,” Hershfield began. “Rising delinquency rates. Real pain around buy now, pay later. It’s important that merchants feel the responsibility to offer more and a savings choice to consumers.”

Hershfield sees this as his and the industry’s responsibility. Help people avoid high credit burdens’ pain, insecurity, and challenges.

He’s also helping merchants spend their customer acquisition budgets more effectively. The average merchant spends 15% or more to acquire customers online, with Google and Facebook raking in the profits.

How Accrue Savings works

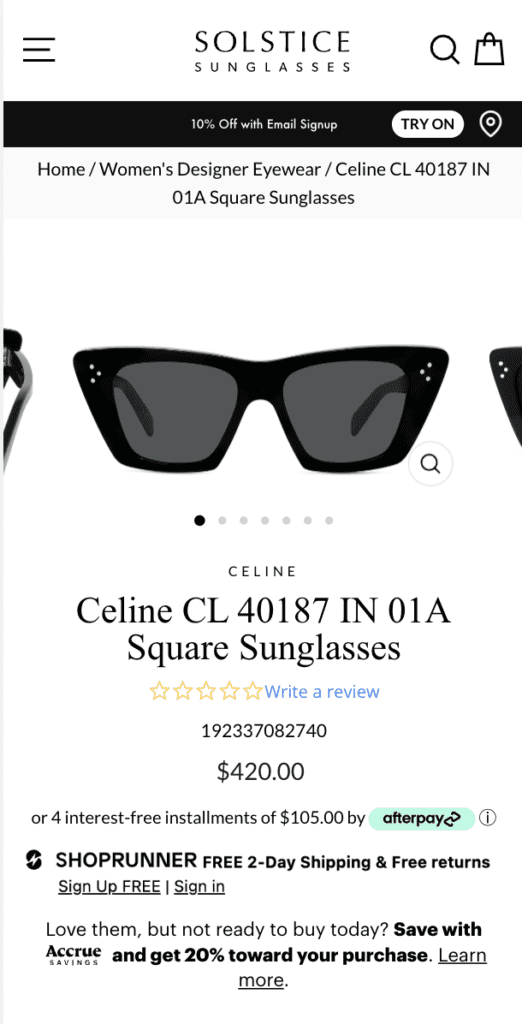

With Accrue Savings, merchants give that money to consumers interested in a company’s products and services. When browsing at an Accrue partner, shoppers can indicate they want to save for the purchase. An FDIC-insured account is set up, and they’re on their way. As they reach savings milestones, companies give them bonuses and rewards to encourage them to keep going.

“And again, it goes back to the ethos and the mission, the business,” Hershfield said. “It’s about the consumer and what they are deserving of. And that is to make the purchase on their own, in their own time, and at the most relevant cost.”

Hershfield said that Accrue Savings’ value proposition benefits consumers at all economic levels. People save for everything from camping equipment to appliances, jewelry, trips, or geothermal heating.

Meeting the growing desire for corporate responsibility

Hershfield believes his timing is right because more merchants acknowledge the humanity of not pushing credit down everyone’s throats. Retain those most interested in you and build long-term relationships with them. Do that well, and you stand out, with more driven to your brand.

“We know corporate America has more responsibility now than ever to be citizens in the system, right?” he asked. “There’s value to them. They’re almost obligated to it. Socioeconomically some people resonate with this product. They are familiar with points. It also reflects the need for people from lower or middle-class backgrounds that might be risk averse when it comes to credit or who don’t qualify for credit.”

Upending sales funnel

Accrue Savings flips the sales funnel upside down. Hershfield said more than 90% of consumers who visit an e-commerce page never make it to checkout. Affirm and Klarna try and increase sales at the bottom of the funnel. For the few who get that far.

Hershfield’s thinking about the 90% who are thinking about it. He’s meeting their needs much earlier in the consideration phase. With so much focus on cart abandonment, it’s clear brands are worried about that 90% too.

“Maybe they’re saving up nine months in advance for it, and they’re not ready to engage much earlier,” Hershfield said. “Reward them instead of spending money with Facebook and Google to try to keep top of mind with them. You reward them with a savings account well before.

“People are dealing with their own challenges, leading to hardship and pain. And it doesn’t need to be this way; it doesn’t need just to be credit after 50 and 60 years of innovating on credit. There could be another way that still gets merchants what they want, which is sales, and gives consumers what they want, which is the thing.

“There’s another path.”